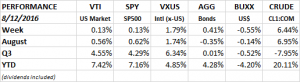

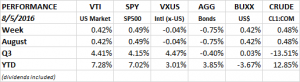

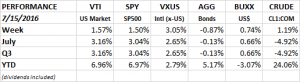

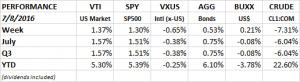

PERFORMANCE

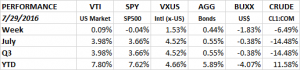

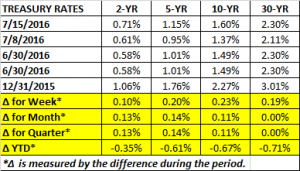

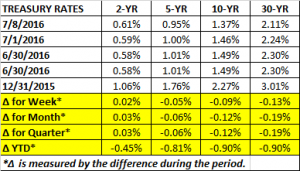

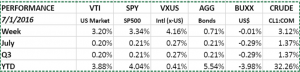

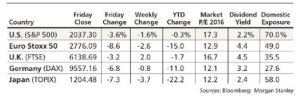

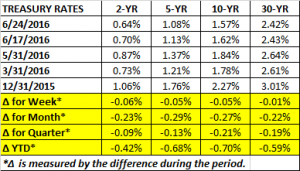

It was another flat week as the US equity markets increased by about 0.13%. The story was better worldwide (x-US), gaining 1.79%. Bonds increased 0.41% as rates fell by about 9 basis points on treasuries that mature in 10 years or longer. The dollar fell by 0.55% and crude had a big rally, advancing 6.44%.

On Thursday, all three major indexes (Nasdaq, SP500 and Dow) hit new highs. That was the first time that has happened since the last day of the last century, December 31, 1999. Despite that, there has been no big spike higher in US equities, the market has broken out from its recent range and has moved only slightly higher.

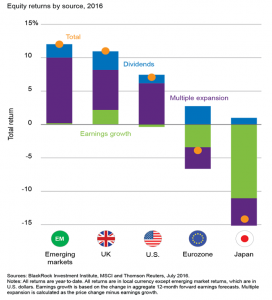

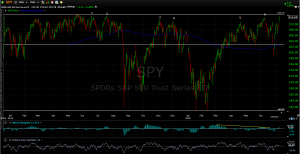

What has been making a decent move higher are emerging markets. The chart below shows the VWO (Vanguard Emerging Markets ETF). The fund was up about 1.8% on the week and is up 16.7% on the year. Maybe emerging markets are up because on some valuation metrics, such as price to book, this is one area that is still reasonably priced on a historical basis compared to US equity markets. Or maybe, given US politics, Brexit, and other disconcerting geopolitical events, emerging markets don’t look so different from the more established developed markets!

The chart does show a negative divergence between the moving average convergence/divergence (MACD) indicator and the price action. The former is moving lower while the latter is moving higher. Sometimes that indicates a pullback is due.

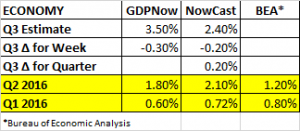

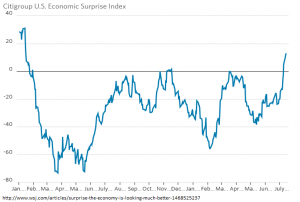

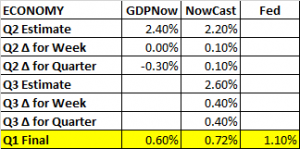

ECONOMICS

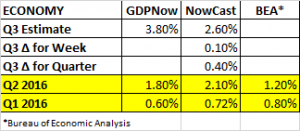

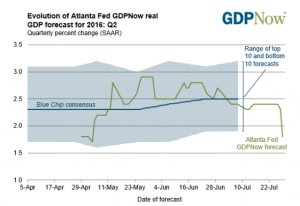

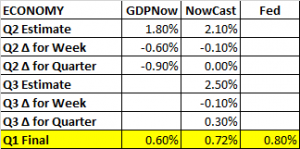

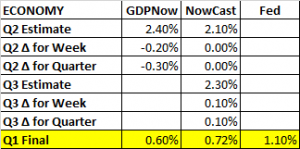

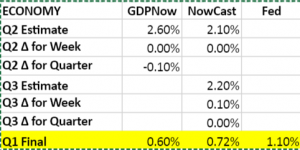

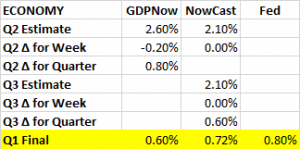

Retail sales came in flat for July, after have a nice increase in the prior months. The consensus was for a 1/2% gain, so the report was a disappointment. The slowdown hurt GDP estimates, and Q3 estimates for both GDPNow and the NowCast fell on the report.

Jobless claims remained steady, falling by 1k to 266k.

THE BENEFITS OF FREE TRADE

Trump especially, but Clinton also, have been railing against free trade. The unfortunate part of all of this is that cutting back on free trade will hurt the majority of Americans. Free trade may not make good politics, but it does make good economics, and ultimately, free trade improves the economy, not hurt it. Specific, legitimate trade issues, such as theft of intellectual property or government subsidies, should be dealt with, but don’t take down the entire free trade infrastructure which has vastly improved economies around the world including here in the United States. Trade wars are dangerous, it has already been tried once, and it didn’t work out so well (read up on the Depression and Smoot-Hawley).

Read Dan Ikenson’s piece from the Cato Institute for more.

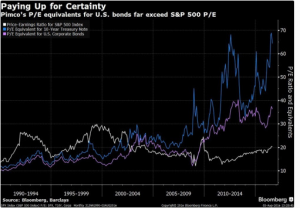

LIBOR ON THE RISE

While interest rates have been falling just about everywhere else, The London Interbank Offered Rate (LIBOR) has been on the rise. LIBOR is currently 0.82% up from 0.33% a year ago. LIBOR rates impact costs for banks, businesses and individuals. LIBOR costs are up because of money-market reforms that have pushed funds into government debt instead of LIBOR based debt. This is another unintended consequence of government regulation. As demand for LIBOR based debt has dried up, rates have increased. Short-duration bond funds should be benefactors but anyone with debt tied to LIBOR is now paying more.

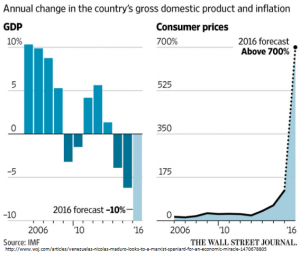

VENEZUELA CONTINUES TO UNRAVEL

Venezuela continues to violate every rule of economics as the Chavez/Maduro team further destroys the country. President Maduro now has turned to a Marxist professor from Spain for advice. Even most leftists now agree the country needs to open up the economy for any hope for positive change. But Maduro is going in the opposite direction, with the help of his new friend, Alfredeo Serrano. There will now be more state control, not less! Massive food shortages are the result of price controls and expropriations. Not according to Serrano, they are the results of “speculative capitalism” and companies hoarding products.

However, at the end of the week, Venezuela did make one good move, they announced they would open up their border with Colombia. That at least is one step in the right direction.