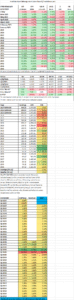

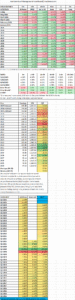

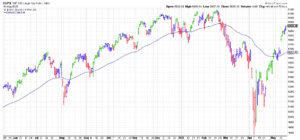

| The S&P 500 index fell 0.4% this week as tensions between Israel and Iran reached a boiling point.

The S&P 500 finished the week at 5,976.97, breaking its two-week winning streak, though it remains up 1.1% for June and 1.6% in 2025.

Israel launched attacks on Iran early Friday morning, killing Iran’s senior-most military leaders. Iran reportedly retaliated, firing missiles toward Israel. Iranian media said its government will not participate in talks scheduled with US officials this weekend.

The attacks follow long-simmering tensions between the countries.

Oil futures jumped more than 7% on Friday after the attack, on concerns that the conflict will curb oil shipments from the Middle East.

The week had been upbeat as the US and China agreed to a trade framework following two days of talks in London. China will resume rare earth and magnet shipments, though it will put a six-month limit on the shipments in a bid to maintain leverage should trade tensions sour. US President Donald Trump announced the deal, pending approval from both leaders.

US consumer sentiment jumped to 60.5 in June, significantly exceeding May’s 52.2 and consensus forecasts. One-year inflation expectations fell to 5.1% from 6.6%, while five-year expectations also declined, indicating easing consumer concerns about future price increases.

Inflation in May unexpectedly slowed to 0.1% month-over-month, below the 0.2% Bloomberg consensus, driven by lower energy prices. Annually, the Consumer Price Index accelerated to 2.4%, matching expectations, up from April’s 2.3%.

Producer prices rose 0.1% in May, the first increase in three months, according to the Bureau of Labor Statistics. Last month’s rebound fell short of the 0.2% Bloomberg consensus

Most sectors rose this week, led by a 5.7% increase in energy and a 1.2% increase in healthcare.

APA (APA), Halliburton (HAL), and ConocoPhillips (COP) led the rally in energy, each climbing over 10%.

Halliburton (HAL) said it was selected by Repsol Resources to support the full lifecycle of the Spanish company’s assets in the North Sea.

Eli Lilly (LLY) was up 6.4%, the company’s Chief Financial Officer, Lucas Montarce, said it will only partner with telehealth firms that stop selling copycat versions of its weight-loss drug Zepbound.

Financials declined by 2.6% and industrials fell 1.6% this week.

Visa (V) fell 4.7% while Mastercard fell 4.8%, after several companies were reported to be considering their own stablecoins in the US. Walmart (WMT), Amazon (AMZN), Expedia (EXPE), and several major airlines have been weighing plans to launch stablecoins, according to The Wall Street Journal’s report.

Next week, earnings reports are expected from companies including Haleon (HLN), Ferrovial (FER), and Accenture (ACN).

Economic data will include May’s US retail sales, import price index, and industrial production as well as June’s home builder confidence index.

Provided by MT Newswires. |