Performance

Brexit was the driver of the equity markets all week, it moved the market higher through Thursday and then drove the market much lower on Friday in reaction to the “exit” vote.

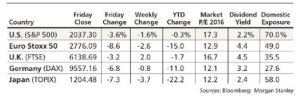

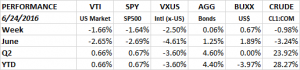

Friday’s losses put the market into the red for the year (excluding dividends). Excluding dividends the SPY is down 0.36%. Including dividends the SPY is up 0.67% on the year. Worldwide, about $2 trillion in market value was erased on Friday. The FTSE 100, made up of the 100 largest companies listed on the London Stock Exchange, fell 3%. However, when taking into account the massive drop in the value of the pound (about 9%), the index fell about 12% in dollar terms. The SP500 dropped 3.6%.

For the week the US market was down about 1.64% (SPY), overseas was down 2.50%. The aggregate bond index stayed above breakeven, +0.06%, the dollar got a boost as a safe haven, +0.67% and oil fell by 0.98%.

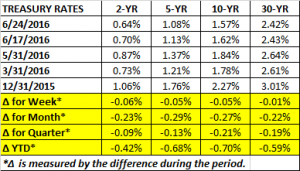

Treasury rates fell about 5 basis points for 10-year bonds and less. The 30-year remained steady falling only 1 basis point.

Technical Analysis

The equity markets rallied from Monday through Thursday. The market was anticipating a “remain” vote on the Brexit. What was interesting is that the close on Monday, Tuesday and Wednesday was towards the low for the day. It was as if the “smart money”, which is generally believed to trade towards the end of the day, was saying “not so fast” on the anticipated “remain” vote. But that caution was thrown to the wind on Thursday as the market shot higher by 1.30%. It looked like the market was setting up for another run at the all-time high. The market was clearly anticipating a “remain” vote but “exit” is what it got, and that set up the market for the 3.6% drop on Friday. The SPY did hold support at about $203 as it has on two recent occasions. The problem would be if the market can’t hold support, there is lots of empty space below.

Brexit

On June 23, history was made when the United Kingdom voters elected to leave the European Union (EU). While free trade and regulation were on voter’s minds, limiting immigration was likely the main motivation behind the vote. The EU is a union of 28 states and includes four of the world’s seven largest economies. The UK is the world’s fifth-largest economy representing 4% of the global economy. While the result of the election had a huge impact on financial markets, it is important to remember that at least as of now, this is a political event, not a financial event. In other words, the market went down because of politics, not because of a pending immediate threat to the financial system (like a major bank going under).

The vote itself is not binding, and the splitting of the UK from the EU will likely be a long and complicated process, adding a lot of uncertainty to the process. An act of Parliament needs to be passed to give the EU formal notice of the UK’s intent to leave. Then negotiations begin on the terms of the exit. And to make matters worse, the UK Prime Minister, David Cameron, resigned after the vote and will leave office in a few months.

From an economic standpoint, the question is what happens to the trade agreements? Dropping EU membership means a possible loss of the favorable trade agreements that the EU provides. The EU is the largest trading partner for the UK, accounting for one-half of UK exports. The UK also needs to attract foreign capital to help cover its current-account deficit. That might be more difficult now.

Under two scenarios laid out by the International Monetary Fund (IMF), UK GDP will drop by 1% by 2021 (more favorable) or more than 4% (unfavorable).

But the impact on the UK is only one part of the problem. Another part is how this impacts the EU. This will affect the EU economy but it might also result in the EU itself splitting up. Other countries might be tempted to vote themselves out of the EU. Given that UK voters decided to leave mainly because of immigration policies, and because this same immigration policy is the main impetus for other countries to leave the EU, it would probably be smart for the EU to restructure itself to be primarily an economic (free trade) union, and leave everything else to traditional negotiation between countries.

A third impact is the knock-on effect on the US dollar and the Japanese yen. Both currencies are likely to increase in value, hurting exports and lowering domestic profits.

In sum, Brexit opens up a long period of uncertainty and markets do not like uncertainty. However, the world economy is not going to end, although there will probably be some short-term downside. Countries will still trade with each other and people are still going to live and buy products. Slow growth is expected to continue and the world will adjust. Even in the UK, many economists still expect growth. Deutsche Bank Chief Economist Mark Wall is looking for UK GDP growth of 0.9% versus 2.1% had the UK remained in the EU. He see Eurozone growth of 1.1% instead of 1.5%.

Fed

Janet Yellen said the chances of a recession this year are “quite low”. A WSJ survey of economists puts the chances of a recession in the next year at 21%. Yellen noted that wages are picking up and that economic output has improved in the second quarter. Yellen indicated that rates would increase gradually and cautiously, she did not give any hint of when. She also said she was not interested in following Japan and Europe to negative interest rates.

Yellen’s comments were before the Brexit vote. Now after Brexit, the chances of a Fed rate hike, at least this year, have dropped dramatically. We are probably looking at Q2 of 2017 at the earliest.

Inflation

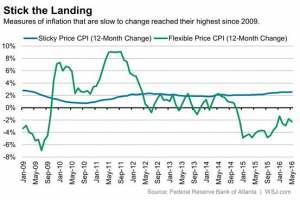

We wrote last week that inflation pressures are building in the system. The WSJ ran a story earlier in the week showing that the “sticky-price” CPI, items that fluctuate in price less, such as household furnishings and personal care products, rose at the highest rate since 2009. According to researchers at the Atlanta Fed, changes in “stick-price” items incorporate expectations about future inflation more so than other measures of CPI.

Economy

The US Coincident Index rose 0.2% indicating continued slow growth. Existing home sales increased 1.8% in May. Single-family sales were up 1.9%. the highest level since February of 2007. Distressed sales now represent only 6% of the market, a year ago it was 10%. The Architecture Billings Index increased by 2.5 points to 53.1, another good sign for growth. ATA For-Hire Truck Tonnage increased 2.7% in May. That was the first gain in three months and was up 5.7% year over year.

GDP

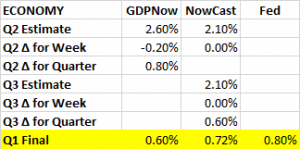

The Atlanta Fed’s GDPNow estimate for Q2 declined to 2.60% from 2.80% last week. The estimate for real residential investment growth fell to 1.7% from 3.6% after the US Census Bureau released data on new home sales, prices, and construction costs. The contribution of inventory investment also declined. Both factors resulted in the lower estimate. There was no change in the Q2 and Q3 estimates for the NY Fed’s NowCast. The NowCast projects growth at 2.10% for Q2 and Q3. If you split the difference between the two forecasts for Q2, and if the estimates hold at these numbers, the growth would be 2.35% versus 0.80% in Q1, an improvement for sure.

SUMMARY

The uncertainty created by the “exit” vote will likely dampen economic activity worldwide at least initially. Over the medium and long run markets should adjust. Brexit was a political event not an economic one, although you can make an argument that it can turn into an economic event down the road. Interest rates were pushed lower, which will offset some of the negative impact from Brexit. And with such low rates, equities arguably remain attractive. From a technical perspective, the market is resting on a major support line. If it breaks support expect further downside in the short run.