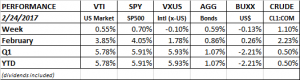

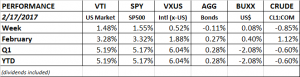

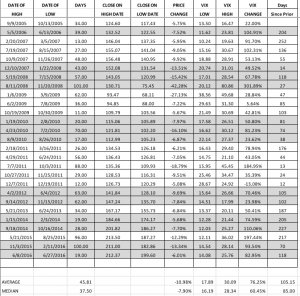

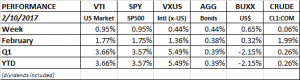

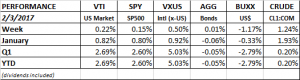

PERFORMANCE

It was another winning week on Wall Street, as US equities rose by about 0.60%. The Dow is now on an 11-session winning streak, that is the longest stretch since January of 1987 when the index put together 12 wins in a row.

The market has had the wind to its back, and either this big run will turn out to have correctly anticipated an improved economy and higher profits in the near future, or, we will continue with more of the same slow to moderate growth path. If the ladder scenario turns out to be correct, then the market has gotten ahead of itself and it will have to likely correct through either time (via a somewhat flat performance) or by price (as in a correction of some type).

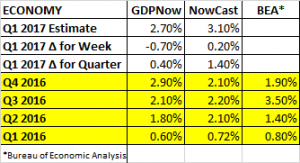

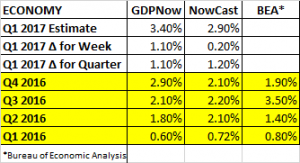

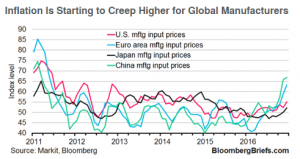

There are some positive signs that the economy is accelerating. And if we get positive corporate tax reform, roll back on regulations that do not meet cost/benefit tests, and repatriation, then maybe this run up is justified. However, all of that happening is a big “if”. We will learn more when Trump rolls out his plans and what the response in Congress is. Treasury Secretary Steve Mnuchin is aiming for a tax-reform package to be passed by August. The market will also need a friendly Fed and no negative surprises on the geopolitical front.

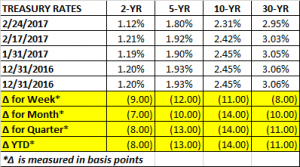

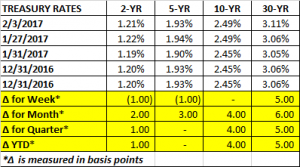

FIXED INCOME

The bond markets are not exactly in sync with equities. Rates were lower across the curve this past week. A much improved economy would likely see higher, not lower, interest rates. The 10-year treasury yield is now at the lowest level since November. The German two-year note now yields -0.95%, close to a record low. However, unless lower interest rates are foretelling a recession down the line, they do help provide support for higher equity values.

EARNINGS

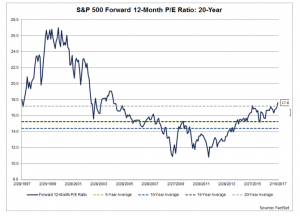

According to FactSet, 92% of SP500 companies have now reported. 66% beat the mean earnings estimate and 52% have beaten the mean sales estimate. The blended earnings growth rate is up by 4.90%. For Q1, 67 companies have issued negative guidance and 31 have issued positive guidance. The forward p/e now stands at 17.7.

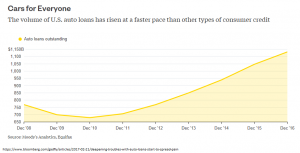

WARNING LIGHT

The US auto loan market has risen at a faster rate in recent years than most other types of consumer credit and now those loans are showing signs of stress. Delinquencies are up to the highest level since 2009 and are expected to get worse. Auto loans outstanding total about $1.1 trillion, significantly less than the $8.9 trillion US mortgage market. About 1/4 of auto loans are considered subprime. Most of the pain will be felt by smaller tier lenders, but companies like Capital One and Ally have exposure.

HOME SALES

Existing home sales rose to the highest level since February of 2007 in January. Sales were up in three of four regions across the US. Sales only fell in the midwest. Inventories hit an all time low, at 3.6 months, indicating a tight market.

JOBS

Jobless claims rose by 6k to 244k, but that is still a very low number and shows that the labor market is close to full employment.

DEBT CEILING

The debt ceiling comes up for renewal in March. No one is talking about it but this is a complication that the Trump will have to get through.