HIGHLIGHTS

- A brutal sell-off as US stocks drop by 4% and international stocks were off by 3.55%.

- Stocks fall through previous support.

- A solid 3.5% increase in Q3 GDP.

- Consumer spending highest since 2014.

- Key inflation gauge comes in lower than expected.

- Recession risk is better than 50% going out two years according to a JP Morgan model.

- The overvalued Canadian real estate market is starting to slow down.

MARKET RECAP

It was another brutal week on Wall Street. US stocks fell by 4%. Overseas, was not much better, down 3.55%. Bonds rallied by 1/2% as interest rates fell. US stocks are off by 9.87% from their August 29th high and international stocks are now down by 20.43% from their high on January 26. The S&P 500 was down by 10.3% from its September 20th closing price at its low on Thursday.

Stocks cut right through support established by previous lows earlier in October, June and late May. The next level of support is around the 2580 area on the S&P 500, about 3% lower from here. According to Ned Davis Research, bear markets that occur within an environment without a recession normally stop after a drop of about 20 to 25%. That doesn’t mean we fall that far, or can’t fall further, but that level has some historical support.

The US economy still looks good and at least so far, there does not appear to be a recession on the immediate horizon. The Commerce Department reported that in its initial estimate of Q3 GDP growth, the economy expanded by a solid 3.5%. Consumer spending was up by 4% in the third quarter, the best reading since 2014. And in more good news, the PCE price index, a measure closely watched by the Fed, showed inflation at 1.6%, less than the expected 2.2%.

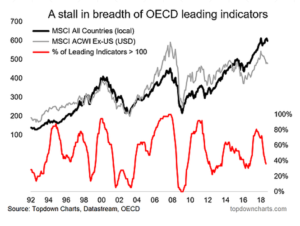

But worries abound, the Fed is looking at four more interest rate increases of 25 basis points by the end of 2019. The drawdown of the Fed’s balance sheet continues, $271 billion over the last year and it continues at the rate of $50 billion per month. The trade war with China is starting to get more and more play as companies report earnings and discuss their outlooks going forward. There is the uncertainty regarding the midterm elections, the threat of a recession in the next year or two, budget problems in Italy, and the messy coverup of a murder by Saudi Arabia.

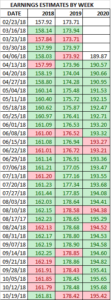

At this point though, the decline is taking on a life of its own and might be dropping for technical and psychological reasons as selling begets more selling. Valuations are starting to look reasonable. If 2019 earnings estimates can hold at the current levels, the S&P is only selling at about 15x earnings. Traditionally though, earnings estimates decline as the period approaches.

RECESSION RISK

A JP Morgan model that predicts the chances of a recession has the US at about 28% within one year and 60% in the next two years. Going out three years, the odds increase to higher than 80%.

US & CANADIAN REAL ESTATE

Sales of existing homes in the US were down by 3.4% in September from August, and 4.1% year over year. It was the seventh consecutive monthly decline. Higher home prices and interest rates are getting the blame.

The red-hot Canadian housing market is also slowing down. According to the Canadian Real Estate Association, “About 70% of local markets were down on a y-o-y basis, led primarily by declines in major urban centres in British Columbia, along with Calgary, Edmonton and Winnipeg.” Home buying was down in September, year over year, by 8.9%, it was a six-year low for September. Vancouver, the hotbed of the Canadian boom, was down by 43%. The average sales price was basically flat, up by 0.2%.

While the US has also experienced a slow down in real estate sales, Canada has a bigger threat in terms of valuation. According to Steve Saretsky, a Canadian real estate analyst, the average home sales price in Canada is $371,000 (USD) versus $296,800 in the USA.

SCOREBOARD