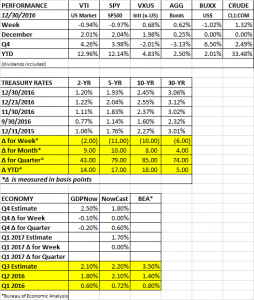

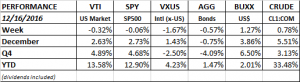

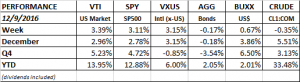

PERFORMANCE

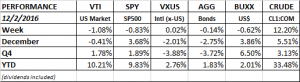

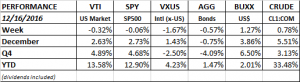

US markets were down 0.32%, international down 1.67% and bonds fell 0.57%. The US dollar continued its march higher, +1.27% and crude oil advanced 0.78%. The VTI (US markets) hit its high for the week on Tuesday at $117.53 and closed on Friday at $116.77, off 0.65%. That amounts to a major pullback by the standards of the last few weeks!

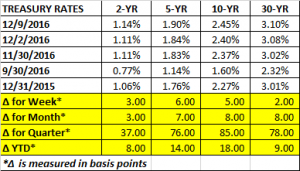

FED

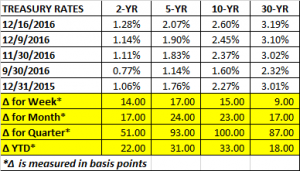

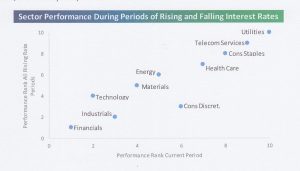

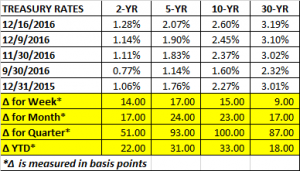

The Fed raised interest rates for the first time in a year by 1/4 point. That increase was expected. What was not expected was that the new “dot plot” shows three hikes next year, not the two that had been anticipated. Even with that, the equity market took the news in stride and there was no major sell off. However, treasury yields did jump.

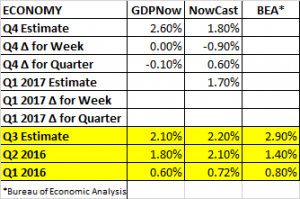

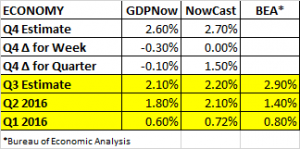

GDP

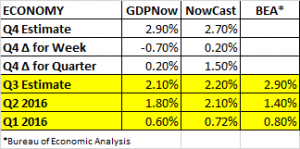

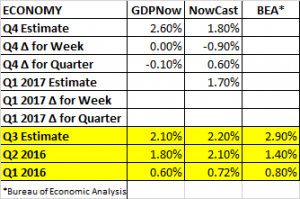

The Atlanta Fed’s GDP model remained unchanged for Q4 growth at 2.6%. However, the NY Fed’s Nowcast tumbled by 0.90% to 1.80%. The move lower was led by negative reports for capacity utilization, industrial production, and housing data. The Nowcast also came out with their initial Q1 forecast for 2017 at 1.70%. Growth estimates have been falling off. As recently as 11/25 GDPNow forecast Q4 growth at 3.6% and the Nowcast was at 2.50%.

The news is better on the international front. The percentage of individual-country manufacturing PMIs that expanded in November was 78%, the highest level since April of 2014.

SENTIMENT SURGES

More confirmation that optimism continues to surge in light of the Trump win, the National Federation of Independent Business said its small-business optimism index jumped 3.5 points to a seasonally adjusted 98.4 in November, the strongest monthly gain since April 2009. This is in line with several other sentiment type polls.

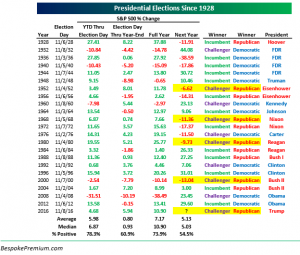

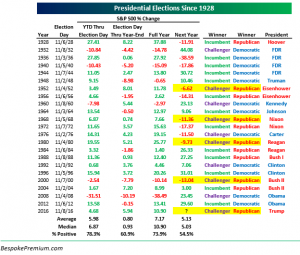

A STRONG POST-ELECTION RUN IS NOT ALWAYS GOOD NEWS

A strong post-election rally does not always portend a good year to follow. Since 1928, the market has advanced by 5% or more between election day and year-end five times (not including this year). Those years were 1928, 1952, 1960, 1980 and 2004. The market fell in 1929 by 11.91%, it fell in 1953 by 6.62% and it fell in 1981 by 9.73%. There was one big advance, +23.13%, in 1961. And the market inched up by 3% in 2005.

AND REPUBLICAN TAKEOVER OF THE WHITE HOUSE IS NOT ANY BETTER

The market also has not fared well since 1928 when a Republican has won the Presidency following a Democrat. In 1953, when Eisenhower won, the market fell 6.62%. In 1969 with Nixon, the market fell 11.36%. In 1981 with Reagan, the market fell 9.73% and in 2001 with Bush II, equities fell 13.04%.

CHINA

China is an area of concern and has the potential to set back the market on multiple fronts. Barron’s cover story this week is on the danger of a trade war set off by Trump, “If he were to make good on his most aggressive tariff threats, we could plunge into a major global recession.” Then you have the issue of the plunging Chinese currency, the controversy over Taiwan, and now the stolen drone.

CALPERS TO LOWER INVESTMENT TARGET

The California Public Employees’ Retirement Systems (CALPERS) is going to meet on Tuesday about lowering their 7.5% investment goal to 7% or 7.25%. They think a 7.5% annual return is unrealistic in this environment. Lowering the goal has real life consequences for cities and municipalities all over California and really everywhere has many other pensions funds follow the CALPERS lead. By lowering the goal, any drop in expected investment returns would have to be made up with more contributions from the employers (the municipalities) which would mean some combination of spending cuts, higher taxes, more borrowing.