Monthly Archives: July 2023

Week Ending 7/21/2023

Week Ending 7/14/2023

MARKET RECAP

It was another big week for stocks as US markets advanced by 2.71% and a super strong 3.91% outside the US. Bonds were up 1.46% as interest fell on a good inflation report.

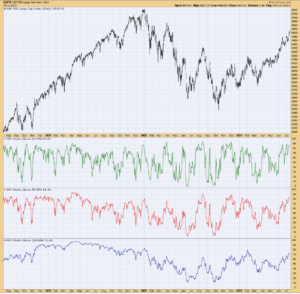

The market appears to be broadening out, the equal-weighted S&P 500 has doubled the S&P 500 performance over the last six weeks, 6% v 3%. The S&P 500 trades at 18.9x earnings, but when you back out the seven leaders (that trade at 40x), the index trades at 15x. Meanwhile, quarterly earnings are expected to drop for the third quarter.

The market appears overbought. 83% of S&P 500 stocks are above their 20-day exponential moving average, 82% are above the 50-day, and 71% are above the 200 day. Two of the last times stocks were at similar metrics, greater than 80/80/70, led to sell-offs. From February 1, 2023, to March 13, the market fell by 6.4%. Prior to that, the other time was at the end of 2021, which turned out to be the last peak of the S&P 500. The market would fall by about 25% over the next ten months.

MARKET RECAP

Week Ending 7/7/2023

MARKET RECAP

After a big June where US stocks advanced by 6.73%, stocks were flat this week, +0.01%, while international markets fell slightly, down by 0.36%. Bond took a big loss of 0.96% on higher interest rates. The yield on the 1-year treasury was up by 24 basis points.

The market no longer anticipates a drop in interest rates this year and is counting on a rate increase at the next meeting in late July. Despite falling just shy of the consensus for nonfarm payrolls, the payroll report that came out this week still reflected a solid labor market, thereby putting to rest the chance for a near-term pause in interest rate increases. Payrolls increased by 209,000; the estimate was 230,000. It was the first miss after a 14-month winning streak. The two prior months were revised down by 110,000. The workweek was up to 34.4 hours from 34.3 in May, and average hourly earnings were up by 0.4%. The unemployment rate fell to 3.6% from 3.7%.

SCOREBOARD

June Recap

June 2023: A Month of Sunshine for Wall Street, With Clouds on the Horizon

June 2023 painted a more vibrant picture for financial markets than the previous months. Optimism reigned, but simmering concerns remained beneath the surface. Here’s a breakdown of the key themes:

Equity Market Rally:

- Major indices enjoyed a strong month, buoyed by better-than-expected economic data and positive earnings reports.

- The S&P 500 surged 5.8%, marking its best June performance since 2019. The Dow Jones followed suit, climbing 4.5%, and the Nasdaq Composite soared 32.32%, its strongest first-half performance in four decades.

- Small-cap and mid-cap stocks outperformed, playing catch-up with large tech companies that had dominated earlier in the year.

Economic Resilience:

- The US economy displayed surprising resilience, with GDP growth increasing to 2.0% for the first quarter.

- Consumer confidence improved, and initial jobless claims declined, fueling hopes for a continued economic recovery.

- However, worries remained about the sustainability of this growth, especially with rising interest rates and ongoing supply chain disruptions.

Central Bank Tightrope Walk:

- The Federal Reserve maintained its 0.25% rate hike pace but signaled the possibility of future increases depending on inflation data.

- This cautious approach balanced inflation control with concerns about stifling economic growth.

Sector Rotation and Commodity Recovery:

- Value stocks continued to outperform growth, with consumer discretionary leading the charge.

- Technology stocks still performed well, but the pace of their gains slowed compared to earlier months.

- Commodity prices rebounded slightly, with oil prices edging higher amid concerns about potential OPEC output cuts.

Global Market Performance:

- International markets underperformed the US, with the MSCI EAFE and MSCI EM returning less than the S&P 500.

- This highlighted the uneven global economic recovery and different monetary policy stances adopted by central banks.

Other Notable Events:

- The war in Ukraine continued to impact energy prices and disrupt supply chains.

- Geopolitical tensions between the US and China remained high, adding to market uncertainty.

- Investor focus shifted towards the upcoming mid-term elections in the US and their potential impact on economic policies.

Overall, June 2023 was a month of positive gains for financial markets, driven by improving economic data and strong corporate earnings. However, clouds of uncertainty continued to linger, fueled by concerns about inflation, rising interest rates, and geopolitical tensions. The second half of the year will be crucial in determining whether the optimism of June can persist or if underlying anxieties take hold.