HIGHLIGHTS

- US and international equities advance by just over 2%.

- The first official GDP estimate of Q4 growth comes in at 2.6%.

- Some comparisons to 1987.

- Retail investors getting back into the market.

- Government shutdown ends (until February 8).

- Trump imposes tariffs.

MARKET RECAP

Equities continued to ramp higher, up just over 2% in the US and around the world. Bonds managed a 0.18% advance. The dollar fell by 1.70% on comments by Treasury Secretary Mnuchin that a lower dollar would help US exports. The dollar is down 3.81% for the month.

GDP

The first official estimate for Q4 growth came in a 2.6%, significantly lower than the GDPNow estimate of 3.40% and the NowCast estimate of 3.88%. The estimate is subject to future revisions, but if it holds it stops the two-quarter plus 3% streak and keeps growth in-line with the pattern we saw under Obama.

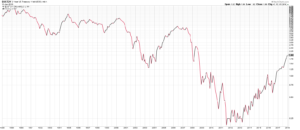

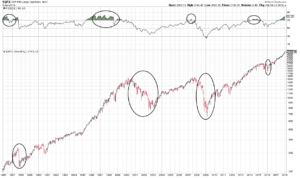

1987 ALL OVER AGAIN?

This is in no way a prediction that this year will turn out like October of 1987, when the market crashed by 32%, but the consistent rise in the markets brings back some memories from the first few months of 1987. Here are some common themes as we read through past issues of Barron’s:

- Equities are heading higher, but experts think that “bullishness is not out of control.” (Barron’s 2/9/1987)

- The Dow doubles without even one 10% correction.

- Aggressive “high-yield” lending.

- Equities have gone up while the dollar was going down.

- Equities increasing with “effortless ease”. (Barron’s 3/2/1987)

RETAIL INVESTORS

Discount brokerages like TD and Schwab reported a jump in new retail clients to close out 2017. Lisa Beilfuss writes in Saturday’s WSJ that the strong trading activity suggests “…the market rally is entering a “melt-up” stage that is bringing in once-skeptical investors.” (WSJ, 1/27/2018, Retail Investors Jump Into the Market)

SHUTDOWN

The government shutdown ended late Monday when Congress passed a continuing resolution to keep the government funded through February 8.

TARIFFS

Trump imposed tariffs and quotas on imports of solar panels and washing machines. The tariffs will impact China and South Korea. More US companies are now expected to seek protection. A case is likely to be brought to the World Trade Organization. If this is the start of the roll-out of the Trump protectionist agenda, slower economic growth, inflation and a hit to equity markets all now become heightened risks. Meanwhile, the rest of the world goes on in promoting free trade, 11 Pacific-rim countries agreed to form a trade bloc without the US.

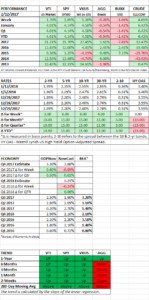

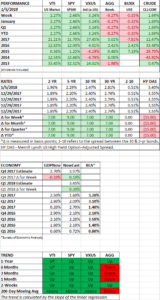

SCOREBOARD