MARKET RECAP

Financial markets hit new 2022 lows and oil dropped by 5.7% on Friday to close out the week. Oil is now down 36% from its June high. Over the last two weeks, the S&P 500 has fallen by 9.2% and the Nasdaq by more than 10%. The 2-year treasury yield closed at 4.22%, the highest level in over a decade. The composite PMI in the US was in contractionary territory at 49.3, but that was up from 44.6 in August.

A Eurozone recession is pretty much a certainty now and the odds for a US recession seem to be rising by the day. And to make matters worse, Putin has doubled down on his so far losing strategy in Ukraine and called up 300,000 reservists and threatened nuclear strikes.

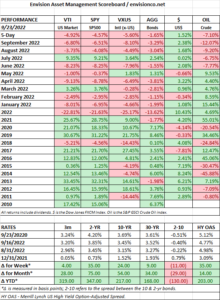

SCOREBOARD