HIGHLIGHTS

- Stocks take another hit.

- High-yield spreads are opening up, while treasury yields fall.

- The consensus is changing on interest rate hikes for 2019

- Oil is pummeled.

- Trump and Xi to meet.

MARKET RECAP

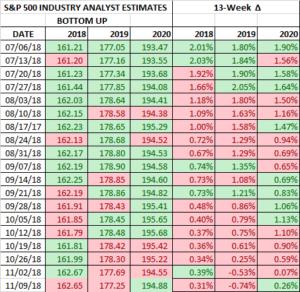

US equities were hit hard, falling by 3.53%. The S&P 500 was off by 3.83%. International stocks continued their recent relative out performance but still fell by 1.99%. US stocks are about 1.5% away from dropping through the low hit on October 29th. Equities will have to hold that level to put in the beginning of at least a consolidation process.

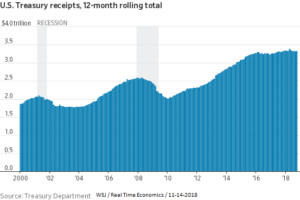

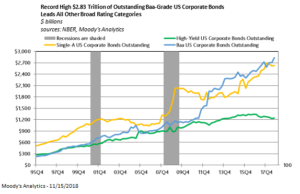

While yields on Treasury bonds were generally down a couple of basis points, the spread on high yield bonds continued to increase. The 10-year treasury yield is down by 10 basis points this month, but the high yield spread is up by 44 basis points. That indicates investors are backing away from debt most susceptible to a slowing economy. Bank loans and floating rate instruments have taken the brunt of the hit, a chart of the Invesco Senior Loan Portfolio (BKLN) is indicative of the damage.

FED

The consensus is rapidly shifting that the Fed will have to back off its aggressive posture of three rate hikes in 2019. The futures market has priced in just one rate increase in 2019. That would be in addition to the projected December rate hike. It looks like projected GDP growth is slowing. Both the GDPNow and the NY Fed Nowcast model have Q4 growth at about 2.5%, down from 3.5% last quarter and 4.2% in Q2.

OIL

Oil was pummeled. WTI crude dropped by 10.7% for the week and is now down 22.8% for the month and is down by 34% from its October 3 peak.

TRUMP and XI

President Trump and Chinese leader Xi will meet in Buenos Aires this week. Trump said he very prepared for his meeting, “I know every ingredient, every stat. I know it better than everybody knows it. My gut is always right…China wants to make a deal. If we can make a deal, we will.” The Chinese currency (yuan) is hanging on by a thread, without a deal, the threat rises of the yuan falling through an important psychological barrier, resulting in possible contagion throughout global markets. The selloff in January of 2016 was driven in part by fears of a falling yuan.

SCOREBOARD