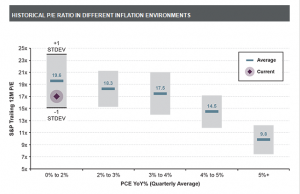

Now here is an argument that the p/e ratio still has room to expand. A Bloomberg / Guggenheim chart shows that the average trailing p/e when inflation is between 0% and 2% is 19.6. Currently, that ratio is 17x, and if you go out 1 standard deviation you get to 24x.

Monthly Archives: February 2014

A Cape Crusader

In this GMO White Paper, the author argues that in “Stock Broker Economics” the market is always cheap, but the Shiller PE and other valuation measures argue otherwise, which will lead to low returns in the future, click for his case.

Barron’s 2/24/2014

Notes from Barron’s 2/24/2014

CAT – CAT is up 7.4% this year after a slow 2013 when it advanced just 3.3%. You would think it shouldn’t be advancing given the problems with emerging markets and with miners. But Deutsche Bank’s Vishal Shah, says that nonresidential construction could be accelerating and that generates 40% of revenue. Commercial construction usually lags behind the residential construction rebounds by 15 to 18 months, which would be later this year. Shah thinks CAT could trade up 25% to $122 this year.

REVIEW

DJ30 -0.32% to 16,103

SP500 -0.13% to 1,836.25

Most of the economic reports last week came in less than consensus.

Facebook will buy WhatsApp for $19b and some are calling that a bargain. That comes to $42 per user which is comparable to the price Google bought YouTube for and less than the $131 per user that Twitter is going for.

PREVIEW

| DAY | EVENT | CONSENSUS | LAST PERIOD |

| T | FEBRUARY CONSUMER CONFIDENCE | 80.1 | 80.7 |

| W | JANUARY NEW HOME SALES | 400K | 414K |

| TH | JANUARY DURABLE GOODS | -1.05% | -4.20% |

| F | Q4 GDP PRELIMINARY | 2.50% | 3.20% |

| F | FEBRUARY CHICAGO PMI | 57 | 59.6 |

| F | FEBRUARY MICHIGAN SENTIMENT | 81.2 | 81.2 |

FOUR STOCKS WITH DIVIDENDS THAT COULD DOUBLE

Dividend growers will do better in a interest rate rising environment as compared to high yielders. They are also are usually more expensive based on forward p/e ratios, by about 20%, according to a Bank of America Merrill Lynch analysis.

Four stocks with dividends that could double their yields in next five years:

AIG, DFS, HAL and IR. Also mentions CVS.

YIELD OF DREAMS

Growth is slowing at Kinder Morgan. KMP trades at $79 and yields 6.9%. Kinder Morgan Inc (KMI) controls KMP. KMP has an unfavorable relationship with KMI, it pays for most of all of the new projects but almost half of the distributions go to KMI.

Distributable cash flow, which is an internal measure, might be too aggressive in its calculation. CapEx that is considered for maintenance reduces distributable cash flow, while CapEx for expansion does not. KMP might be understating the maintenance and overstating the expansion. Expansion capital is funded with new debt and equity, they raised $540m last week.

Typical MLP calculation of distributable cash flow is equal to net income + depreciation – maintenance capex.

KMI determines what is maintenance and what is expansion capex. KMP projects DCF of $5.61 per unit with an expected distribution off $5.58. But an analyst at Hedgeye says a more accurate number is $4, putting a 15 multiple on that gets to a price of $60 and the analyst thinks KMP deserves a lower multiple than 15. If the distribution gets cut, look for a big price drop.

MANAGED WITH METTLE – KALU is priced at $69. Value is $80 per Stephen Levenson of Stifel, Nicolaus based on 8x ebitda. EPS to rise to $3.99 and $4.33 next year. 2% dividend.

Howard Marks on the free lunch

Howard Marks on the free lunch (or lack thereof).

http://www.bloomberg.com/video/oaktree-emphasizes-risk-control-in-investing-marks-4Ugtil0LQAGyUuh5e05Ojg.html

Using short interest when deciding when to sell

Mark Hulbert writes in this weekend’s WSJ that the level of short interest might be a useful indicator when determining when to sell stocks. Generally, the problem is that investors often hold stocks that they have done well with too long.

Adam Reed, a finance professor at UNC, says “short interest is one of the strongest return predicative signals in the academic literature.”

Barron’s 2/17/14

Note from Barron’s from 2/17/2014. We encourage readers to purchase Barron’s for the complete set of news, some of which are highlighted very briefly below.

Up & Down Wall Street – Stephanie Pomboy of MacroMavens says the markets capitalization has hit 200% of GDP, compared to 204% during the dot-com-bubble and 183% at the peak of the housing bubble.

_______________________________

Review

DJ +2.3% to 16,154

SP500 +2.3% to 1,838

Comcast is buying Time Warner cable for $45b.

Congress increased the debt-ceiling limit through March 2015, February 27 was when borrowing capacity would have run out.

_______________________________

PREVIEW

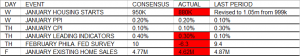

| DAY | EVENT | CONSENSUS | ACTUAL | LAST PERIOD |

| W | JANUARY HOUSING STARTS | 950K | 999K | |

| W | JANUARY PPI | 0.2% | 0.4% | |

| TH | JANUARY CPI | 0.1% | 0.3% | |

| TH | JANUARY LEADING INDICATORS | 0.4% | 0.1% | |

| TH | FEBRUARY PHILA. FED SURVEY | 10.0 | 9.4 | |

| F | JANUARY EXISTING HOME SALES | 4.77M | 4.87M | |

| Source: Bloomberg/FactSet | ||||

_______________________________

Buckle Up!

This could be the hottest economy since the late 1990s according to Applied Global Macro Research based on strong outlook for housing. They are currently invested in consumer discretionary and home builders indexes. This outlook differs from consensus which has 2014 at 2.7% followed by 3% in 2015.

_______________________________

Gulf Driller’s Shares Look Ready to Rally

EPL – $27.35 – trades for less than the value of reserves. Asset value is $41 per Stephan Berman of Canacord Genuity assuming $90 per barrel. Share count reduced by 3% over last three years.

_______________________________

A New American Team Goes for the Gold

AAL could gain 50% or more in time.

_______________________________

New Strategies for MLP Investors

Streak of MLPs beating the SP500 ended at 12 years last year. Payouts average 5.7% now. They finance construction and other infrastructure management by borrowing which will be impacted if interest rates rise. Companies need to generate real returns. Group has 60% of the volatility of the market. Returns equal yield plus distribution growth or 6% + 7% = 13% (about) but interest rates and commodity prices are the wild cards.

Stephen Marasca – top pick is LNG. Most upside and least downside. Current price ignores two new projects. TRGP – 28% growth this year. OKE – dividend hike.

John Edwards – PAA is best-in-class operator. MMP – strong balance sheet, solid management and low commodity price risk.

Rise in rates prices will go down in a knee-jerk reaction but if rates are rising due to a better economy spreads should tighten.

Always be careful of distribution coverage – what MLP can pay out divided by what they are paying out. EPD has a strong coverage ration of 1.4.

No gap standard for measuring maintenance capex.

Maresca arrives at price targets by taking expected cash flow and dividends and discounting it back. Discount rates based on commodity exposure and credit quality of customers.

Edwards likes MWE. Located in good areas.

Maresca likes ETE and ATLS.

Greg Reid likes WGP, NGL and RGP.

______________________________________________

HEALTHY GAINES AHEAD FOR CVS

13.9x next year’s earnings. David Larsen of Leerink Partners thinks shares could hit $85 (from about $70) in a year. Recently been beating estimates.

Using the VIX as an indicator

Using the VIX has proved effective as a short-term indicator over the last 8 months. The VIX is a measure of implied volatility of the S&P 500 index options. The VIX will go up in value when fear is high, and go down in value when fear is low.

You can use the VIX as a contrary indicator, going short the market when the VIX spikes and going long the market when the VIX dips. We looked at two ways to measure this, first, we used a 20-day Bollinger Band with two standard deviations and second, a 10-day envelope channel with a 10% spread. The Bollinger Band would generally provide a more extreme measure.

Since the VIX spikes faster when the markets are fearful, we used the Bollinger Band when fear is rising, and then we used the envelope channel when fear was receding. If the VIX closed below the Envelope Channel, we marked the SP500 chart below with a green up arrow, indicating a buy signal. And if the VIX closed above the Bollinger Band we market the SP500 chart with a red sell signal.

We only did this for the last six times, on the upside and the downside, when these signals have occurred. But the VIX has been fairly accurate picking short term tops and bottoms, the only team it clearly failed was on the October 16th down signal.

Barron’s 2/3/2014

Note from Barron’s from 2/3/2014. We encourage readers to purchase Barron’s for the complete set of news, some of which are highlighted very briefly below.

Akami (AKAM) – is the WD-40 of the internet. Movement to cloud will help. Big opportunity is selling security services. Analysts expect 14% sales gain and eps of $2.15 this year. Price is currently $48.47 and selling at 22.5x earnings, but normally 25x. A similar multiple next year puts the price at $62. CEO bought $1.1m in December when priced at about $45. Q4 earnings release is this Wednesday.

The Cheapest Tool in the Box – Stanley Black & Decker (SWK) – had disappointing earnings last quarter. Recent price $77.87. Now at 14.5x forward earnings less than peers SNA and ITW and at substantial discount based on p/s and p/b. Charles Bobrinskly of Ariel Focus fund thinks stock could eventually be worth $100/share, “Investors have overreacted, by paying too much attention to quarterly results.” Julisuz G. Sas of GSSR has a $93 sum of parts break up value.

Diet Firm’s Shares Could Get Plumber – Weight Watchers (WTW) – meeting attendance down 16% in September and subscribers fell 5% for online offering. NI expected to drop 14% on a 7% drop in revenue on the next report in a few weeks. New CEO has laid out turnaround plan. Mark Boyar likes the shares, thinks stock could come close to doubling over next two years. New CEO plan calls up increased investment in core business, driving innovation and services to corporate customers for employees. Suspension of dividend will be used to improve balance sheet. Boyar see profit at $4/share by 2017, intrinsic value in the low 50s in next two years.

Ford or GM: Which One is the Better Buy? – F is at 11x and GM at 9x this year earnings forecast. GM might be better bet for 2014 but F for the longer run. GM can gain 30% over the next year versus 20% for F, both stocks yield 3.3%. F $14.96, GM $36.08. F has better products and scale. F is further along on consolidating platforms (scale). GM has a newer lineup for this year. GM expected to earn $4.21 this year, +25%, and $5.20 next year. Right now at 7x NY earnings.

Canada’s Hidden Gem – Imperial Oil (IMO) – produces oil mainly from unconventional fields in Western Canada. 70% owned by XOM. 10.7x ’14 eps estimate. Has been hurt by cost overruns and delay of XL pipeline as well as train accidents. Oil sands are also not environmentally friendly. Low dividend and has focused cash on expansion.

Recent price $40.76.

The Trader – Bed Bath & Beyond (BBBY) – $63.85 down over 20% from recent high. Q3 EPS rose to $1.12, +8.7%, falling short of expectations. Lowered guidance for Q4 and fiscal year ’14 to $4.79 to $4.86. Alan Lancz recently bought shares for clients. $3/share in cash and no LT debt. No dividend. Small internet presence.

Roundtable Part 3 – Mario Gabelli – JRN – $9 – owns 13 television stations, 35 radio stations and one newspaper. EBITDA will be about $75m and eps $0.55. MG values the newspaper at 4x EBITDA, TV stations at 8-9x and the radio at 7-8x. Could be worth $13 – $15. Has pension liability that should decline with rising interest rates.

DBD – $33.63 – bloated cost structure and cutting costs. EPS $1.35. If turnaround works shares could double.

CHMT – specialty chemicals – $26 – share count could fall to 70m from 96.5m in the next 3 years. Could sell for $45 in a couple of years. In takeoff stage of turnaround.

NFG – $70 – owns gas utility in Buffalo that is worth $20/share. Has pipeline business that it has not monetized and a growing exploration and production business. Could be worth $100/share.

WFT – needs to clean up its balance sheet.

POST – $50 – CEO is recreating strategy he used at Ralson Purina via acquisitions and synergies. Could have $500m in three years. CEO is great value-adder.

Brian Rogers – AMAT – likes laggards that can turnaround. $17.50 – 2.3% yield. Consensual merger with Tokyo Electron. Will buy back 10% of shares within 12 months. In 2 years, $2-$2.50 of earnings power. Lots of upside with a 12x on that.

CNX – $36.63 – could get to $45 to $50.

CVC – $16.88, could be a $22 stock. 3.6% dividend.

ETR – could earn $5 this year. $61, 12x, yield 5.2%. Low growth, unexciting company with a safe dividend. It wouldn’t take much to earn a total return of 15% in next year or two.

NEM – $23.80 –

PRMSX

Fred Hickey – recommends holding cash to buy things after dislocation. Like gold, CEF, sells at high discount to NAV (6%).

GG – is growing. 2.6% yield, sells below BV of $25.54 at $23.19. Mines are in good locations.

GDXJ – you can get massive moves up in gold stocks.

CCJ – uranium play. Overhang in supply is done.

Scott Black – “key is to buy businesses that generate free cash and will be able to sustain growth.” ESRX – $72.86 – Revenue should be up 10% in 2013, could earn $4.32 versus $3.74 in 2012. Revenue growth could be zero this year but earnings could be $4.92 this year due to shift to generics and better SGA. Company thinks it can grow earnings by 10-20% per annum for next few years. Will benefit as more people come into the system.

ACT – 13x future earnings at 14.3x current. $183.32/share. Earnings can be $9.35 versus $6. Can earn $12.83 (next year??). Has a set goal of 10% annual growth in eps. Has launched many generics recently.

BCEI – small energy exploration and production company in Colorado.

KLAC – $63.62 – a money machine. Great long term pick.

SNDK – leader in flash memory.

All is good

Well the market decided that everything is good again, as the SPY powered higher by 1.32% to close at $177.48. Today, economic news fell on the positive side of expectations as US jobless claims fell to 331,000 from a revised 351,000 last week which beat the forecast of 337,000. Also, worker productivity rose to 3.2% versus the 2.8% forecast.

Disney came out with better than forecast earnings, moving higher by 5.3%. GE was up 1.8% and BRK.B plus 1.3%.

The market will need to push through 180 to break through the last high and to keep the momentum going. There is a big unemployment report tomorrow.

Market tumbles

The Dow dropped 326.05 points or 2.1% and is now down 7.3% for the year.

Automakers reported that car sales fell last month. However, the weather was terrible in most of the nation. Sales west of the Rocky Mountains, where weather was normal, were good. The 10-year treasury note rallied as the rate fell to 2.585% and gold moved higher.

The Institute for Supply Management’s index of manufacturing came in at 51.3 in January. The index was 56.5 last month and the consensus was 56.1. Again, the weather was brutal in January and we do not know how much that really impacted this number.

The psychology of the market has now clearly changed even though the economics are pretty consistent. The markets were probably propelled higher than maybe they should have been last year in large part due to QE. QE resulted in investments and decisions that might not have been made had interest rates not been manipulated in recent years. That, coupled with a change in psychology and some untimely news overseas (and all of these factors might be related in some manner) have damaged the market.

But the truth is that markets do not go up forever and sell offs can often represent opportunity. And QE had to end sooner or later. Time will tell…