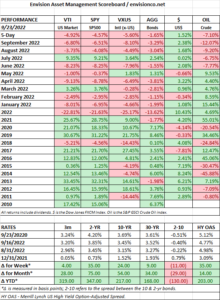

Scoreboard

Author Archives: admin

Week Ending 1/6/2023

MARKET RECAP

- S&P 500 +1.45%

- Wage inflation dropped to 4.6% year over year, down from 5.1%. Long-term yields fell, and stocks went up on the news.

- The unemployment rate fell to 3.5%.

- ISM services fell into contractionary territory for the first time since May 2020.

- Earnings estimates for 2023 from bottom-up strategists are for a 4.4% increase, while top-down analysts projected a 2.7% decline.

- Fed minutes indicate they are not satisfied with the progress on inflation.

- The consensus is that we are headed to recession; Larry Summers and Alan Greenspan both said this past week that a recession is a likely outcome.

- It took 15 rounds of voting to elect Kevin McCarthy as the new speaker of the House. A clear indication of the dysfunction of the Republican party. The Republicans were held hostage by the crazies on the far right. They should have used the opportunity to combine with Democrats and elect a speaker more towards the center of the political spectrum to take power away from the extremes on both sides.

- This election is not good news for negotiations on the debt limit later in the year.

SCOREBOARD

Week Ending 12/23/2022

MARKET RECAP

US stocks fell slightly, down 0.17%, while international stocks managed a 0.60% advance. Bonds dropped by 1.39%.

Personal spending was up by 0.1% in November, down from 0.9% in October, indicating a slowdown in consumer spending. At the same time, the personal consumption expenditures price index increased by 5.5% year over year in November, down from 6.1% in October. Month to month, the increase was only 0.1%, compared to 0.4% in October. So, inflation seems to be dropping at a decent pace.

Caroline Ellison and Gary Wang, two senior executives at FTX/Alameda, pleaded guilty to fraud and to cooperate in the government’s investigation. In the meantime, ringleader Bankman-Fried was bailed out of jail on a $ 250 million bond.

SCOREBOARD

Week Ending 12/16/2022

Week Ending 12/09/2022

MARKET RECAP

Investors were on the retreat this week as the market bounced off the declining trend line dating back to the highs at the beginning of the year, thereby keeping the downtrend in place. US stocks were off by 3.57% and international stocks by 1.49%. According to Refinitiv Lipper, there was a $26.6 billion outflow from the domestic equity mutual and exchange-traded funds over the seven days that ended Wednesday, the biggest weekly outflow since April 2021.

Investors are looking toward Tuesday’s consumer inflation report, which is expected to show that inflation has continued to decelerate. But the producer-price report, released on Friday, came in higher than expected, at +0.3% in November versus the 0.2% estimate.

SCOREBOARD

Week Ending 10/21/2022

Week Ending 10/14/2022

Week Ending 10/7/2022

MARKET RECAP

Stocks managed to advance by 1.63% for the week. The market was strong at the beginning of the week on another hope that the Fed will pivot sooner rather than later, but as that became apparent that was more hope than real, the market fell hard at the end of the week.

Employers added 263,000 jobs in September, less than the 315,000 added in August and lower than the six-month average of 400,000, but more than the consensus estimate. The unemployment rate fell to 3.5% from 3.7%, matching a half-century low. The labor force participation rate declined. The stronger than expected report sparked another sell-off in the markets, worried that the slowdown in forthcoming interest rate increases in now further away. The S&P dropped by 2.8% and the Nasdaq fell by 3.8%.

Cracks continue to appear in the economy. AMD, Samsung, and Micron Technology have all issued weak forecasts.

SCOREBOARD

Week Ending 9/30/2022

Week Ending 9/23/2022

MARKET RECAP

Financial markets hit new 2022 lows and oil dropped by 5.7% on Friday to close out the week. Oil is now down 36% from its June high. Over the last two weeks, the S&P 500 has fallen by 9.2% and the Nasdaq by more than 10%. The 2-year treasury yield closed at 4.22%, the highest level in over a decade. The composite PMI in the US was in contractionary territory at 49.3, but that was up from 44.6 in August.

A Eurozone recession is pretty much a certainty now and the odds for a US recession seem to be rising by the day. And to make matters worse, Putin has doubled down on his so far losing strategy in Ukraine and called up 300,000 reservists and threatened nuclear strikes.

SCOREBOARD