HIGHLIGHTS

- Capped by a strong rally on Friday, equities finish higher by about 1/2%.

- Earnings season continues to be exceptionally strong.

- Deficits are exploding and neither political party cares.

MARKET RECAP

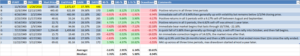

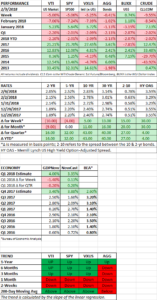

It was a somewhat boring week by recent standards, but equities did advance. The US markets were up by about 0.50% and international equities increased by 0.21%. What was of some interest is that the market finished way off its highs, and close to the low of the day, from Monday through Thursday, but that changed on Friday when the market rallied into the close and ended at the day’s high. The Friday rally was attributed to a fall in the yield on the 10-year Treasury of almost 5 basis points. The S&P 500 is now up 8 of the past 10 days and has increased by 6.4% since the February 8 low.

EARNINGS

90% of the S&P 500 have reported Q4 earnings so far and 76.5% have beaten expectations and 15% have fallen short, according to Thomson Reuters I/B/E/S. That compares to the average beat rate of about 64%. Overall, Q4 earnings should be up by 15.3% and revenue should be up by 8.2% from Q4 2016.

The graph below illustrates how earnings expectations for Q4 have been sharply rising since December.

Looking forward, 127 companies projected higher-than-expected earnings for 2018, compared to an average of 49 companies over the last 10-years. The p/e based on 2018 earnings is 17.4.

DEFICIT

The US Treasury sold a whopping $258 billion in bonds this past week. The two-year note went for a yield of 2.25%, the highest since 2008. The supply was absorbed by the market and yields across the curve were flat for the most part. But recent sharp increases in Treasury yields have been anticipating this big increase in supply. The huge auction is just a sign of things to come, and we think a dangerous one at that. Recent tax cuts will increase the deficit by more than $1 trillion over the next decade, and you can add to that the recent budget deal, which will increase the deficit by an estimated $420 billion over that period. And all of that is before the Trump infrastructure plan.

The government is now set to borrow more as a percentage of GDP in the next fiscal year, than any year since 1945. Except in 1945 we were fighting WWII, and today we are amid a relatively strong economy and a tight job market. The deficit, in relation to GDP, should be going down, not up! And what happens during the next recession?

Bond yields tend to trend in one direction for extremely long periods, they can be generational in length. In 1946, the long bond yielded 2.25%, 35-years later in 1981, the yield was 15%. 35-years after that, in July of 2016, the 30-year bond yielded 2.1%. Today, the 30-year is at 3.16%. There is an avalanche of federal debt on the way, plus the unwinding of the Fed’s balance sheet. To state what appears obvious, over time, maybe over very long periods of time (with some interruptions along the way), interest rates will continue higher.

Both political parties are completely ignoring this long-term threat of out of control deficits. At some point, tax increases will be back on the table.

SCOREBOARD