HIGHLIGHTS

- Stocks decline by about 1%.

- Oil falls below $0 in futures markets.

- It the real-time economy versus the Fed in the tug and war of the equity market.

MARKET RECAP

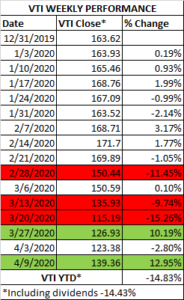

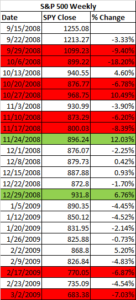

It was a boring week by recent standards, US and international stocks both fell by about 1%. Bonds were up 0.09%.

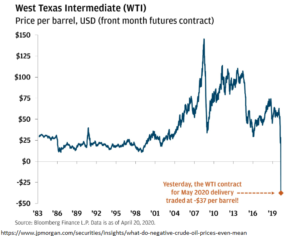

OIL FALLS BELOW $0

The craziness this week was in the oil markets. Oil prices collapsed on Monday with the futures contract for West Texas Intermediate crude falling below $0 for the first time ever. In other words, people were being paid to accept the delivery of oil. The May contract expired on Tuesday and that forced a mad dash to unload contracts. The contract fell to as low as negative $37 per barrel.

The spot price for oil did not fall below $0, but the futures price did. Futures contracts are used by producers of oil to lock in a price to sell oil at a future point in time, and refiners do the same, to make sure they can buy oil at a certain price in the future. And of course, mixed in are speculators who trade the futures contract and provide liquidity. This particular futures contract, for West Texas Intermediate Crude, is for 1,000 barrels of oil and it requires physical settlement in Cushing, Oklahoma. That is different from Brent Crude, which settles in cash.

The actual movement of the crude to and from Cushing is done via pipelines. The problem is that the world is awash in so much oil there was no immediate demand for the product. That meant that if you were long the futures contract, you would have to take delivery of the oil, and if you couldn’t sell it, you would have to store it somewhere. But that presented the bigger problem because although Cushing, OK has storage for about 70 million barrels of oil, just about all of it was accounted for. There was no space to store the oil. That meant that the owners of the contract had no one to sell the oil to and nowhere to store it. So they had to find a buyer of their contract and effectively, at one point, they were paying $37 per barrel to a buyer to take it off their hands. That is $37,000 per contract. And it shows how the shutdown of the economy is impacting markets in ways that have never been seen before.

THE ECONOMY V. THE FED

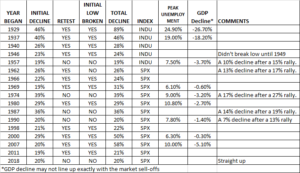

US stocks are currently 17.3% off their high. Which many would argue does not seem to make sense. The legendary investor Howard Marks said on CNBC on Monday, “We’re only 15% from the all-time high of February 19, it seems to be the world is more than 15% screwed up.”

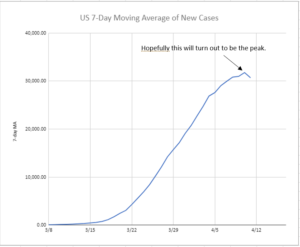

Maybe it does make sense. What essentially we have is a tug of war between the fundamentals of the economy and the power of the Fed. On one hand, the economy is as bad as it has been since the Great Depression. Over 4 million filed for unemployment last week, bringing the total to more than 26 million over the last month. The estimated unemployment rate is 15%. Big retailers like JC Penny, Neiman Marcus, and Lord & Taylor are supposedly close to filing bankruptcy. Orders for durable goods fell by 14.3% last month, hotel occupancy was down by 64.4%, and GDP this quarter is estimated to be down about 7%.

On the other hand, the Fed has expanded its balance sheet to $6.5 trillion in the last two months and Congress has passed the $2 trillion CARES act and another stimulus bill this week for $484 billion. And as we have often shown in the past when the Fed expands its balance sheet, it often finds its way into higher asset prices, hence, the long-time saying – “Don’t fight the Fed.”

So we have this classic match of the muscle of the Fed versus the real-time fundamentals on the ground. Without the Fed, equity prices would almost certainly be much lower. But the Fed’s support is keeping the economy from being even worse, and hopefully buying time until the economy can reopen and start improving. Stock markets also are forward-looking, so investors might have written off 2020 and have their eyes on a better economy in 2021 and beyond. And all of the support by the Fed has resulted in unprecedented amounts of dollars being put directly in consumer’s pockets (“helicopter money”). If and when scientists develop effective therapeutics or a vaccine, the economy should begin to come back, maybe quickly, or at least, that seems to be what investors are counting on.

Investors are also looking at relative valuations.US stocks now have the biggest yield advantage over Treasuries in decades. The S&P 500 dividend yield is now greater than the 10-year Treasury by about 1.3%, which is more than the 1.2% gap in the recession from 2007 to 2009. Now it is true there are dividend cuts on the way, but even with that, the gap will probably remain significant.

Having said all of that, as we wrote about last week, we still think the near to intermediate-term risk is to the downside.

SCOREBOARD