It was a winning week as four of the main indexes we follow advanced. The overall US market as measured by the VTI was up 1.86%, the SPY was up 1.61%, overseas x-US (VXUS) was up 0.12% and the aggregate bond index (AGG) was up 0.15%.

WARREN BUFFET SETS THE RECORD STRAIGHT

Warren Buffet, in his much anticipated annual letter for Berkshire Hathaway, set the record straight (at least in his opinion) on the US economy and the constant negative attacks by our political candidates.

Buffet writes, “It’s an election year, and candidates can’t stop speaking about our country’s problems (which, of course, only they can solve). As a result of this negative drumbeat, many Americans now believe that their children will not live as well as they themselves do.

That view is dead wrong: The babies being born in American today are the luckiest crop in history.”

Buffet writes that American GDP/capita has increased in real terms by a factor of six since 1930.

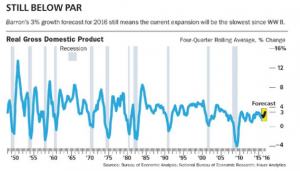

“Some commentators bemoan our current 2% per year growth in real GDP – and, yes, we would all like to see a higher rate. But let’s do some simple math using the much-lamented 2% figure. That rate, we will see, delivers astounding gains.

America’s population is growing about .8% per year (.5% from births minus deaths and .3% from net migration). Thus 2% overall growth produces about 1.2% per capita growth. That may not sound impressive. But in a single generation of, say, 25 years, that rate of growth leads to a gain of 34.4% in real GDP per capita.”

“For 240 years it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs.”

PERSONAL INCOME/CONSUMER STRENGTH/INFLATION/GDP

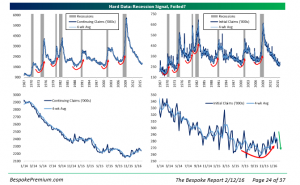

Reports this week show that the much feared threat of recession did not gain traction in January, at least in the United States. Personal income rose 0.5% in January, the biggest increase in eight months. Personal consumption expenditures also rose 0.5%, the most in seven months. This is a good signal for Q1 GDP growth as the consumer spending accounts for 70% of overall growth. Inflation also is picking up, core prices rose 1.7% year over year, close to the Fed’s 2% inflation target. This data suggests the economy is not slipping into recession at this time and would give the Fed more ammunition to increase rates once or twice this year.

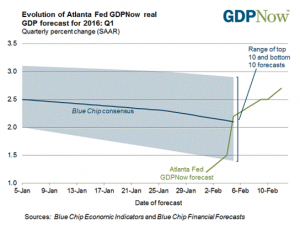

The 2015 Q4 GDP estimate was raised up from 0.7% to 1.0%, matching the GDPNow number for Q4. The GDPNow latest forecast for Q1 growth came in at 2.1% on Thursday, down from 2.5% but still an improvement on the Q4 number.

BANKS/ENERGY LOSSES

Energy related losses are now beginning to pile up at the banks. Wells Fargo (WFC) has allocated $1.2b in reserves for potential losses. “If oil remains low for a prolonged period of time, there could be additional performance deterioration in our oil and gas portfolio resulting in higher criticized assets, nonperforming loans, allowance levels and ultimately credit losses,” according to a securities filing on Wednesday. About 2% of Wells $917b loan portfolio is related to oil and gas. JP Morgan (JPM) is adding $500m in reserves bringing the total to $1.32b. The Company said that if oil is priced at about $25 per barrel for 18 months that bank might need to increase reserves by another $1.5b. But JPMs CEO Jamie Dimon says the bank can absorb the losses. “I put [that] in the drop-in-the-bucket category” relative to the strength of the balance sheet.

Banks also have billions in untapped lines of credit that energy companies can draw upon. JP Morgan has $44b in exposure including $30b that is still unfunded. Dimon says a good portion of that is in loans to investment-grade companies and may not be drawn upon. Bank of America (BAC) has $22.6b and Wells $24.6b in unfunded loans.

Regional banks also have exposure. Regions has about $2.9b in unfunded loans roughly matching the amount already outstanding. SunTrust has $3.1b outstanding and $6.2b unfunded.

VENEZUELA

Venezuela’s economy is spiraling out of control. Since Chavez took power, and continuing with President Nicolas Maduro, the country has made just about every single economic mistake that a country could make. Nevertheless, the country managed to cover the $1.5b debt payment on Friday and says they are committed to meeting their international obligations. At least give them credit for that. Senior economic official Miguel Perez Abad said on Tuesday that “the state will honor its debt.” The reason, a default would open up claims to the assets of the state run oil company, including Texas based Citgo, which is owned by the Company and processes hundreds of thousands of Venezuelan oil every day. Venezuela has about $120b of foreign debt including the oil company. The majority of emerging market debt funds hold some Venezuelan debt. The country also has $30b in other debt to private companies like airlines, pharmaceutical companies, etc. They made the payment this week, but unless oil rebounds future payments are in serious doubt.

EARNINGS

The difference between “pro-forma” reported earnings and earnings based on generally accepted accounting principles (GAAP) reached 25% for the 2015 year. That is the biggest gap since 2008. GAAP are the official earnings although companies will tell you that their pro-forma earnings present a more realistic picture of the earnings. A large difference is not a good signal as they tend to occur at times when the economy is having difficulty. The SP500 trades at 17x pro-forma earnings and 21 times GAAP earnings. For 2015, pro-forma earnings were up by 0.4% but down by 12.7% per GAAP. Most of that difference was due to the energy sector. They reported $45b in income on a pro-forma basis but had a GAAP loss of $48b. Other sectors were guilty also but not to the same extent. Materials had a difference of $27b, health-care $53b and tech $42b. Overall, GAAP SP500 earnings were $787b compared to pro-forma numbers of $1.04t.