MARKET RECAP

The market’s wishful thinking that the Fed would step off the brakes earlier rather than later officially came to a close on Friday in Jackson Hole when Fed Chair Powell said that “We will keep at it until we are confident the job is done.” Powell made clear that there will be no pivot in strategy anytime soon and that the end goal is to get inflation back to the 2%. Fed officials have made projections that rates would need to get to almost 4% by the end of next year for that to happen. Stock plunged, with the Dow dropping by more than 1,000 points. The S&P 500 dropped by 3.4% and the Nasdaq by 3.9%.

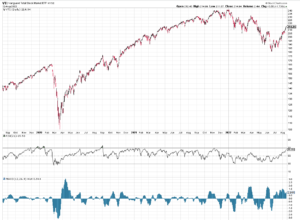

For the week, the overall US market was down by 3.79% and bonds fell by 0.37%. Year-to-date, US stocks are down by 15% and international markets are off by 17.3%, bonds are in the negative by 9.88%.

Powell wants to avoid the mistakes of the 1970s and early 80s when the Fed didn’t follow through on interest rate increases and inflation remained a persistent problem until Paul Volker has to raise rates to very high level to break the cycle.

SCOREBOARD