HIGHLIGHTS

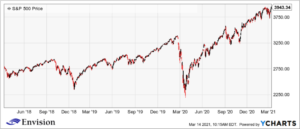

- The US was up by 3.31% and international 1.85%. The Dow and the S&P 500 close at record highs.

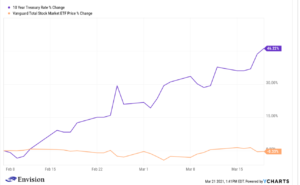

- The 10-year increases by 8 basis points and the 30-year by 12.

- The $1.9 trillion stimulus package is now law.

- Every adult in the US will be eligible for a vaccine by May 1 according to Biden.

- Henry Kaufman worries about the market’s reliance on the Fed…

- …and their independence

- Household wealth at an all-time high.

- GME soars again.

MARKET RECAP

US stocks advanced by 3.31% and international stocks were up by 1.85%. Bonds declined by 0.43% as the long end of the curve continued to see higher interest rates. The S&P 500 and the Dow closed at a record high. The Nasdaq 100, which was off its high by about 10% last week, rallied and is now down 6.3%. A massive stimulus bill and Biden’s announcement that every adult in the US can get a vaccine by May 1 fueled the optimism.

The $1.9 trillion stimulus package was passed into law. The economy was already set for strong growth in 2021, but the economy might really accelerate now with this. This is the likes of which we have never seen before, a massive stimulus package, coming on the heels of two other massive stimulus packages, plus interest rates at close to zero, and a Fed promising to let inflation run hotter than its target with no intervention.

Higher interest rates on longer-term bonds like the 10-year could force expanded P/E ratios to contract, but the bulls are counting on booming earnings to offset the lower ratio to keep stocks on the march higher.

Randall Forsyth writes in Barron’s this week about Henry Kaufman, the widely followed chief economist at Salomon Brothers in the 1970s and 80s, who has written a new book, to be released next month, The Day the Markets Roared. A reference to his call that long-term interest rates would decline back in August of 1982. That set off the rally of the 80s, 90s, and arguably beyond. Kaufman now questions the independence of the Fed. “The implication is near-term political decisions may have greater force over financial market behavior than ever before.” Going on to say that “It seems to be that the equity markets are highly dependent on the continuation of monetary ease.” Basically, we are at the exact opposite point from August of 1982. Back then, we had sky-high interest rates with a tight Fed run by Paul Volker that operated with a long-term view, whereas now, we have artificially low-interest rates, almost at zero, with a Fed willing to monetize most anything and seemingly in sync with the desires of the administration.

Household wealth soared last year by 10% to an all-time high of 130.2 trillion. Of the 5.6% increase in the 4th quarter, almost all of it came from asset price gains.

Gamestop (GME) closed this week at $264.50 and got as high as $348.50. It has declined to about $40 in February after its first incredible run. The recent rally began when Ryan Cohen, the Board member and founder of Chewy, was selected to lead a board committee to work on the Company’s transformation into the digital age. GME is symbolic of this crazy market and some of the rampant speculation that is marking this era.

SCOREBOARD