Some notes from this week’s Barron’s.

UP & DOWN WALL STREET

The world is getting tired of living in a US Dollar world. Nations had to deal with the impact of QE no matter if they wanted any part of it or not. QE pushed foreign currencies higher, hurting those countries exports. Countries around the world are now beginning to look for alternatives to the dollar. So another unintended consequence of massive QE is that the dollar slowly loses its place as the world’s currency. This is certainly not good for the long run.

Stephanie Pomboy of MacroMavens says that the decline of former currencies that at one time held a “reserve” status like the USD today, followed the decline of their international standing.

PICKING UP THE PIECES

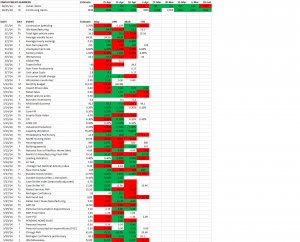

It was time for the Barron’s round table to get together for their mid-year meeting. Gabelli likes IFF, IPG, CHMT, WFT and MSG.

Bill Gross thinks that if fed funds rate rises to about 2% beginning in mid 2015 through 2017, and not to 3-4% like the market expects, that today’s market valuations “are OK.” Gross likes BBN, PDI and PFF.

Scott Black picked SMCI and PDCE. Black said “The market will continue to rise because it is liquidity-driven. There is little downside risk.”

Brian Rogers said “The market turned rocky for a few weeks in April and is bound to have another rocky period in late summer or early fall.” Rogers still likes AMAT, CNX, CVX, NEM, AVP and PRMSX.

Felix Zulauf is targeting a double digit correction for late summer.

Meryl Witmer picked INGR and TATE.UK. INGR is valued at $91 per share via a 14 multiple on FCF of $6.30 per share plus the FCF from this year. INGR is priced at $75.20.

Fred Hickey is not happy. “The averages are up, but the market isn’t healthy internally. There are many divergences. Big-caps are rising, small-caps are falling. Breadth is terrible. The bullish sentiment of professional investors…is near record highs, which signals trouble…There is big trouble ahead.” Hickey’s picks are gold, silver, AEM and short IBM.

Oscar Schafer likes MFI.CA, RLD and AMRI. AMRI is run by the team that built TEVA. There goal is earnings of between $3 and $4 in about the next four years. The stock sells for $17.

Abbey Joseph Cohen selected SIX and BMY.