MARKET RECAP

Fittingly, stocks ended the final week of the year on an up note, with US stocks advancing by 0.67% and international markets by 0.52%. The US markets closed the year just under the Monday high for the year.

For the year, the overall US market was up by 25.67% (dividends included), the Dow by 20.84%, international stocks by 9.00%, the US dollar by 4.2%, oil by 55.01%, and bitcoin by 62.70%. Bonds dropped by 1.77% for 2022.

The labor market remains super hot. There are lots of jobs out there and not enough people to fill them. Initial jobless claims came in this week at 198,000. That is very close to the lows dating back to 1969, and of course, the economy and the country is much bigger now, so proportionally, these are all time lows.

Holiday sales were up by 8.5%, although when you back out inflation of 6.8%, the real increase would be about 1.7%. The Omicron variant is hurting the economy, thousands of flights have been canceled in the last week, and it seems like the virus is literally everywhere. If you don’t have it or if someone in your family doesn’t have it, then a friend or neighbor does, lots of them. The speed with which Omicron is spreading might indicate that it will be peak much quicker than previous variants. Despite the fast moving virus, economists are expecting minimal intermediate or long-term disruption to economic growth.

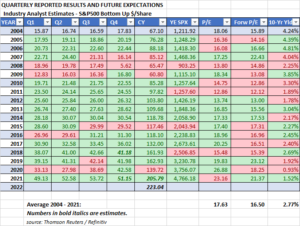

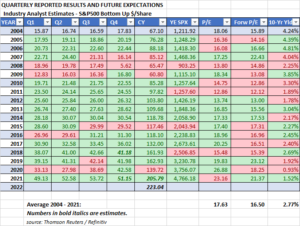

Meanwhile, valuations are still stretched based on traditional metrics. Looking at the price/earnings ratio (see below), the current forward p/e is estimated at 21.37 versus an average since 2004 of 16.50. An offset to that is interest rates remain incredibly low, as an example, the 10-year yield is currently 1.52% versus a 2.77% average (since 2004).

SCOREBOARD