HIGHLIGHTS

- Good news on the trade front with the European Commission.

- Stocks advance 1% around the world.

- $12 billion in tariff relief for farmers.

- Home sales continue to fall.

MARKET RECAP

There was a hint of good news on the trade front this week. European Commission president Jean-Claude Juncker met with Trump and they agreed to work on an agreement with no tariffs and no subsidies (read more below). That, and generally favorable earnings, along with a solid 4.1% estimated increase in Q2 GDP, advanced stocks by 1.07% in the US and 1.08% outside the US. Bonds fell by 0.18%, as yields were up across the curve by about 7 basis points.

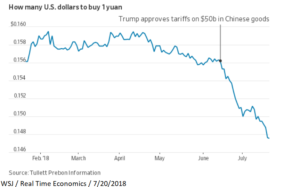

TRADE

Prior to his meeting with European Commission President Jean-Claude Juncker, Trump tweeted “I have an idea for them. Both the U.S. and the E.U. drop all Tariffs, Barriers, and Subsidies! That would finally be called Free Market and Fair Trade! Hope they do it, we are ready – but they won’t.”

The White House team went into the meeting looking to negotiate, chief economic advisor Larry Kudlow said before the meeting, “I just say, keep an open mind—you might be surprised by the outcome of this meeting.”

Surprised we were, the parties agreed to work towards zero tariffs and the removal of all trade barriers for non-auto industrial goods. The EU would increase its purchases of soybeans (very soon) and would import large quantities of natural gas. The two parties would work together to reform the World Trade Organization and to end the theft of intellectual property, forced technology transfers, government subsidies and the selling of products below cost. If all this happens we give Trump and his team major credit. A world with free, or freer trade, will improve economic outcomes across the globe.

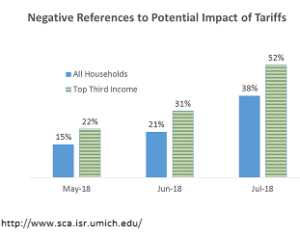

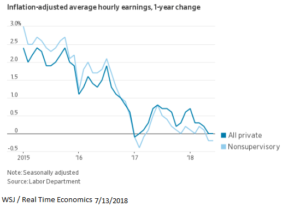

The jump to work a deal with the Europeans might have been pushed along by increasing political heat here in the US. The initial impact of the tariffs is starting to be felt. Earlier in the week, the Trump administration said it would provide $12 billion in support to farmers impacted by the trade war. The costs of tariffs are also showing up on some company conference calls, as executives worry about higher costs and lower sales.

HOME SALES

Existing home sales fell for the third consecutive month and are now down 2.2% year over year. Higher costs are holding back prospective buyers. Prices of existing homes are up 5.2%, and mortgage rates on a 30-year fixed, while still historically low, have increased to 4.54% from 3.92% a year ago. New home sales were down 5.3% in June.

FACEBOOK/TWITTER

Facebook shares fell by 19%, losing $120 billion in market value, as the company projected slower revenue growth going forward. Twitter dropped by 21% after reporting a drop in users. However, most of the drop in users were “fake” or “fraudulent” accounts, apparently, investors would rather Twitter have kept those fake accounts!

SCOREBOARD