HIGHLIGHTS

- The Nasdaq Composite rallied by 2.2% on Friday on the back of strong earnings from AMZN, GOOG and MSFT.

- Earnings are strong and forward guidance is at the best level since 2010.

- The advance reading for Q3 GDP makes it two consecutive quarters of >=3% growth.

- The ECB to halve bond purchases beginning in January.

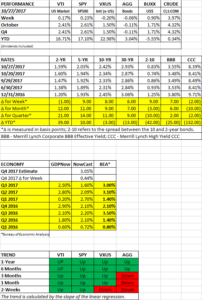

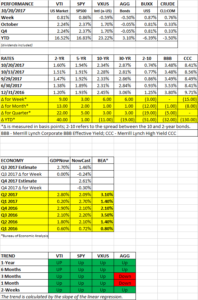

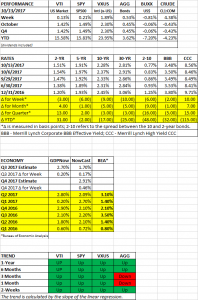

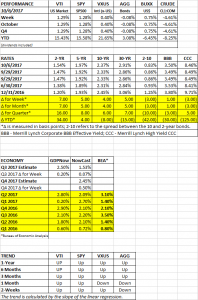

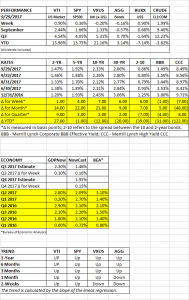

PERFORMANCE

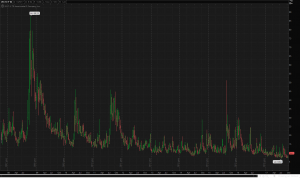

US equities increased by 0.17%, but the NASDAQ Composite surged by 2.2% on Friday and was up 1.1% for the week on the back of strong earnings from AMZN, GOOG and MSFT. AMZN jumped 13% on the day. It was the best day for the index since March of 2016. The dollar increased by 0.90% on dovish statements from the European Central Bank (ECB). Oil was up almost 4%.

International equities were down by 0.20% for the week. But Japan was up. The Nikkei is now on a 16-day winning streak and only declined one-time in October. That breaks the record of 15 set in March of 1988.

EARNINGS

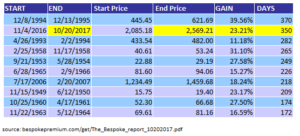

According to the Bespoke (bespokepremium.com) almost 1,000 companies have now reported Q3 earnings. 63.4% have beaten earnings estimates and 61% have beaten sales estimates. Companies overall are optimistic, and as of now, the spread between companies raising guidance versus lowering guidance is +3%, which is the highest level since Q3 of 2010.

ECONOMY

The advance reading of Q3 GDP came in at +3.0%. A strong report given that the quarter was negatively impacted by the hurricanes. That makes back to back quarters of >=3% growth (assuming the number stands in future revisions). For the last few years, Q2 and Q3 have been the strongest quarters, but an early projection for Q4 shows it might be three in a row, the NY Fed NowCast has Q4 growth at 3.05%.

ECB

Mario Draghi announced that the ECB would halve the value of monthly bond purchases to 30 billion euros beginning in January. At the same, they announced the purchases would extend to at least September. The statement was considered dovish by the markets and the Euro fell.

SCOREBOARD