MARKET RECAP

US stocks fell by 0.26% while international markets were up by 0.54%, bonds were flat.

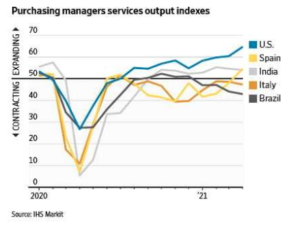

Economic reports were good this week. The IHS Markit Composite Index had off-the-chart numbers, coming in at 68.1 up almost 5 points from last month and much higher than the 50.0 that separates expansion from contraction. The service sector scored 70.1, and manufacturing activity was 61.5, both all-time highs. Unemployment claims were down by 34,000 to 444,000 last week. That was the lowest number since March of 2020. However, economists’ expectations are catching up with the data. However, housing starts were lower than anticipated and the pace of mortgage applications slowed from the prior month. The Citibank Economic Surprise Index has been falling steadily and is at 14.7 now down from about 80 earlier in the year.

Fed minutes released this week alluded to the possibility of slowing the pace of asset purchases sooner rather than later. Currently, the Fed is buying $120 billion a month in securities and most economists did not expect that to be cut back until 2022 without even a mention of it until the August meeting. But in light of it being discussed at the April meeting, the possibility now exists that later in 2021 is on the table. Massive Fed purchases have kept interest and mortgage rates artificially low, pumped up asset prices, led to excess speculation, etc. It also has helped invigorate the economy and reduce unemployment. But the economy has been steadily improving for months now and the longer we are on the medicine the harder and more painful it will be to get off it.

One area of crazy speculation, helped by too much money in the system, is cryptocurrencies. Bitcoin and its cohorts might make up the biggest bubble ever, or maybe it is the future of money, depending upon who you ask. Bitcoin was up by about 600% in the last year back in April but has since fallen 41% to $37,339/coin (as of Saturday). On Wednesday alone, bitcoin dropped by 40% from the previous day at one point. A big argument in favor of bitcoin is its limited supply. While the US and other countries seem to do everything possible to devalue their currencies by issuing more of it, bitcoin’s supply is limited. The problem though is that there is an unlimited supply of potential cryptocurrencies that can simply duplicate bitcoin. There can be Bitcoin 1, Bitcoin 2, etc. In fact, there are already hundreds of alternative currencies that people speculate in that are not even limited in supply. While Bitcoin flattened out before its recent fall, other cryptos were still flying higher day by day. So there is not limited supply. And obviously, there is no intrinsic value in a made-up electronic currency. Having said that, there are lots of very smart investors that believe in Bitcoin as an asset class for the long term.

SCOREBOARD