HIGHLIGHTS

- US stocks fall by 1.14% on continued trade worries.

- The 3-month/10-year spread has inverted again.

- Trade relations with China continue to deteriorate and Mexico/Canada could be next.

- Weak PMI and durable goods reports.

- May resigns as PM increasing the odds of a hard Brexit.

- Positive news in Japan.

- The Vancouver housing bubble is bursting.

- The ratio of copper to gold is falling.

MARKET RECAP

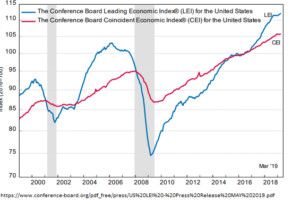

US stocks fell by 1.14% and international equities were off by 0.27% as trade war worries continue to rattle the markets. The Dow is on a five-week losing streak, the longest since 2011. The bond market was up by 0.35%, as demand for government paper has jumped. The 10-year yield fell to 2.327% and is back to being lower than three-month yields, creating another inverted yield curve.

TRADE

Trade relations with China continue to deteriorate. Not content to freeze Huawei from international markets, the Commerce Department is now putting together a list of other Chinese companies to blacklist. All of this will create long-term harm for US businesses. Going forward, why would any international company choose to do business with a US company, all other things equal, knowing their supplies could be cut off at the whim of a US President? Meanwhile, the White House is having problems getting Congress to approve the new trade deal with Canada and Mexico. If Congress does not approve the deal, Trump could follow through on his threat to withdraw from NAFTA, which would be another heavy blow to the economy.

PMI / DURABLE GOODS

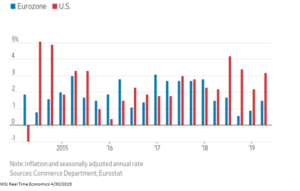

The IHS Markit US manufacturing PMI came in at 50.6 for May, the lowest level since September of 2009. Overall business activity growth fell to a three-year low. “Growth of business activity slowed sharply in May as trade war worries and increased uncertainty dealt a further blow to order book growth and business confidence,” said Chris Willamson, Markit’s chief business economist.

Orders for durable goods fell by 2.1% in April, and the March numbers were revised down. A drop of 25% in civilian aircraft, impacted by the grounding of the Boeing 737 MAX, impacted the numbers.

The combination of weak PMI and durable goods reports has led to lower Q2 GDP estimates. Research firm Macroeconomic Advisers dropped its Q2 estimate to 1.7% from 1.9% and the NY Fed’s Nowcast fell from 1.41% from 1.79%.

BREXIT

Theresa May resigned as British Prime Minister after failing to get a Brexit deal through Parliament. May will remain in office until a replacement is named. Former foreign secretary Boris Johnson is the leading candidate to replace May. Johnson is much more of a hardliner and would be more apt to make a clean break with the EU without a deal. In general, businesses fear the economic shock of a no-deal Brexit.

JAPAN

The Japanese economy expanded at a 2.1% rate in the first quarter, that is up from 1.6% in Q4. The 2.1% also exceeded analysts expectations, who were expecting a flat to a negative number.

VANCOUVER

We have written about the problem with excessive housing valuations in Canada and it looks like the bubble has popped, at least in Vancouver, the epicenter of the excess. Stories abound of expensive homes and condos going for discounts of 25% to 50% off assessed value or recent transaction prices. A quarterly index of prices shows Vancouver values dropping by 14.5% year over year. Land sales were down by 54% in the first quarter.

COPPER/GOLD

The price of copper relative to gold has dropped recently. A falling ratio has been a precursor to some market declines in the past.

SCOREBOARD