MARKET RECAP

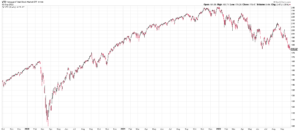

Another incredible week as US stocks rose by 4.16% and are now up 8.81% for the month; this is in the face of what is almost certainly another 0.75% increase in the fed-funds rate this week. Or maybe the market is looking ahead to what often is a market rally after the midterm elections. According to the Stock Traders Almanac, the Dow has averaged a gain of 46.8% since 1914 from the midterm low to the pre-election year high. But that metric will undoubtedly be tested by a Fed focused on slowing the economy until inflation fades.

The Dow is up 14.4% for the month, and assuming nothing crazy on Halloween, will turn in its best performance since January of 1976.

Except for Apple, big tech missed on earnings. Microsoft scraped by with a small beat, but disappointed investors with its outlook, Alphabet’s revenue fell short in the advertising category, and Meta missed on overall sales.

SCOREBOARD