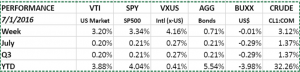

PERFORMANCE

What a week! The market fell hard on Monday by 1.79% and then put in a blockbuster 4-day rally advancing 5.17%. For the week the SP500 (SPY) was up 3.34%, international (VXUS) advanced 4.16% and the aggregate bond index (AGG) was up 0.71%. The US dollar was flat and crude moved up by 3.12%.

While Brexit is a big deal, and while the uncertainty factor is sure to slow growth in the UK and maybe the EU, the market may have initially overreacted. At least for now, Brexit is a political not an economic event. And there was even some talk during the week that maybe the UK won’t even invoke Article 50, which would begin the withdrawal process, and give the EU time to reform itself. The EU would be wise to concentrate their union on the benefits of free trade and leave most of the other issues to traditional political negotiation.

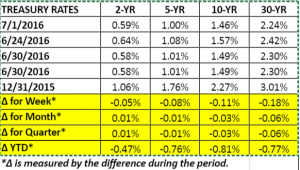

TREASURY RATES

The 10-year Treasury note touched its lowest yield ever at 1.385% on Friday before closing at 1.46%. Let us emphasize “ever”. As in since the founding of the union. Led by fears of the impact of Brexit, investors are betting on more world wide stimulus and/or a weaker economy. Negative yields around the world are dragging down US rates.

Bank of England Chief Mark Carney said on Thursday that the bank’s expectation was slower growth as consumers and businesses react to uncertainty by cutting spending. Carney indicated that the central bank would cut its key rate over the summer. The yield on the two-year British government bond fell into negative territory for the first time after the comments.

Overall treasury rates were down on the week. The curve got flatter. The difference between the 2-year and the 10-year note declined by 6 basis points. The difference between the 5-year and the 30-year declined by 10 basis points.

South Korea

South Korea announced a $17b stimulus package. They join Canada in using fiscal stimulus to get their economies going. Going forward, we will probably see more of this around the world.

Economic Reports

The Richmond Fed Manufacturing Index fell to -7 in June, its lowest level since January of 2013. The Texas Services General Business Activity index fell to -7.7. The near-term outlook declined.

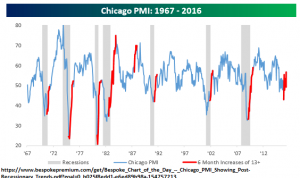

The Chicago PMI came in at 56.8. That is the highest level in eighteen months represents a 13+ point increase over the last six-months. According to the Bespoke Investment Group, in seven of the eight previous times the index increased by that much in that time span, the economy was coming out of recession.

Personal consumer expenditures (PCE) were up 0.4% for May. The combined increase for April and May was the biggest two-month gain since August of 2009. Personal income was up 0.2% in May.

The Philly Fed State Leading Indexes, which are six-month projections of economic activity, show that 40 states are expected to expand, seven to contract and three to remain unchanged.

Pending home sales fell for the first time in four month, dropping 3.70%.

The Weekly Retail Chain Store Sales Index rose 1.5% last week. It is now up 3% from last year.

Initial claims for unemployment insurance rose 10,000 to 268,000. The four-week average is 266,750, that is close to the lowest level since 1973. The labor market remains tight.

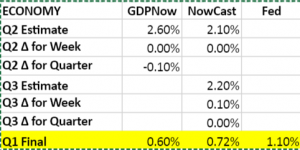

GDP

Q1 GDP was revised up to 1.1% from 0.8%. The original estimate was 0.5%. The actual growth is now more than double the original estimate.

GDP estimates for Q2 and Q3 continue to remain stable. The Atlanta Fed’s GDP estimate for Q2 growth is 2.6% and the NY Fed’s Nowcast came in a 2.10%, both estimates were unchanged for the week. The NY Fed’s Q3 estimate ticked up by 10 basis points to 2.20%.

SUMMARY

The market reversed course on Monday and had a huge rally to close out the week. We are back to about where we started pre-Brexit. Estimated economic growth for Q2 is still projected at 2% plus, an improvement on Q1 and consistent with the slow growth mode we have been in for years.