HIGHLIGHTS

- Stocks around the world fall.

- Oil jumps by 3.49% for the week.

- The Fed increases interest rates by 1/4%.

- Musk is out as Tesla’s chairman.

- The US and South Korea sign a free trade agreement.

- Equities are now the biggest source of household wealth for the first time since the dot-com era.

- Trouble with Supreme Court nominee Kavanaugh.

MARKET RECAP

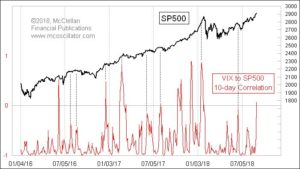

US stocks were down by about 1/2% and international stocks fell by 0.83%. Bonds were up 0.06%. Crude continued to spike higher, up 3.49% for the week and almost 5% for the month. Oil prices are expected to continue to rise as sanctions on Iranian oil begin to start in November.

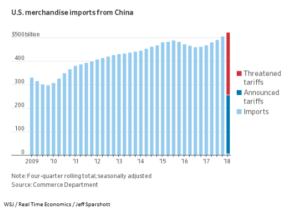

The Fed, as expected, raised interest rates by 1/4%. It was the eight increase since 2015. A trade deal was signed with South Korea and a final deal with Canada is supposedly close. But trade problems with China persist and that will feed into higher prices here in the US as supply chains are interrupted and become less efficient.

TESLA

Tesla agreed to a $40 million dollar settlement with the SEC to settle fraud charges from Elon Musk’s tweet that he had an offer to take the company private. Tesla will have to bring in an independent chairman to replace Musk and add two independent directors and put controls on Musk’s communications.

SOUTH KOREA

Trump signed a free-trade agreement with South Korea. It was the first signed agreement by Trump that will help to open markets rather than close them.

EQUITIES SURPASS REAL ESTATE

Here is a statistic that points to those that argues that equities are way overvalued. In Q2, the value of equities jumped over real estate for the biggest share of household wealth according to Steve Blitz of TS Lombard. The last time that happened was during the dot-com era.

SENATE JUDICIARY PANEL

It was painful to watch, but Supreme Court nominee Brett Kavanaugh and Dr. Christine Ford faced off in Senate testimony on Ford’s accusations that Kavanaugh attempted to rape her in high school. The episode had little impact on the markets but was a prime example of the divide in this country between the two parties.

SCOREBOARD