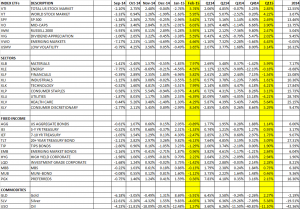

Stocks hit the reverse button last week as markets fell across the board, the SPY fell 2.22%, QQQ fell 2.77%, VTI fell 2.17% (dividend adjusted), VT dropped 1.64% (dividend adjusted) and the AGG fell 1.17%.

We wrote two weeks ago when the market was down about 3% that there wasn’t much fear in the market and there might be more to go. The Fed’s deft handling of the word “patient” last week in its guidance pushed the market up, but that might have been a temporary advance as we were negative on 4 of 5 days this week. The market could be in stall mode until earnings season begins in a couple of weeks.

There were multiple culprits to put the blame on. The US durable goods report was a big disappointment, falling 1.4% in February, pressuring domestic based small cap companies. The Chicago Fed National Activity Index was also down. Biotechs, which have been on a tear reminiscent of tech stocks in 99/00, fell 5%. Investors are worried about repeat of last year when biotechs fell 20% after getting out to a strong start. Oil prices jumped 7% after Saudia Arabia led air strikes against rebels in Yemen. There were, however, two good reports, new home sales had a big beat over expectations and jobless claims fell to 282k.

The market is also worried about the transports. The Dow Transports have had declining highs in 2015. Transports are considered a leading indicator for market performance.

The market has held support in the low 204s two times in the last three weeks. Friday was the one advance of the week as the SPY managed a 0.23% gain.