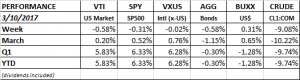

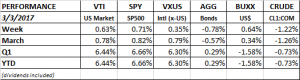

PERFORMANCE

The equity markets fell last week, dropping 0.58% in the US, but international equities were about at break even. Bonds were also down by 0.58% as interest rates continued to rise.

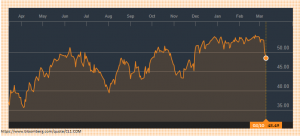

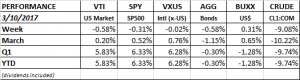

The price of oil fell below $50 for the first time since November as inventories increased to record levels. More negative movement on the oil price is likely to have a spillover effect on the equity and high-yield markets. Oil had rallied in the last several months on news of OPEC production cutbacks. But US shale producers have moved quickly to cash in on the higher prices. That has increased supply in the US at a faster rate than demand. However, demand around the world is increasing and US exports of oil and gas should also increase as time goes on, and that should alleviate some of the excess supply.

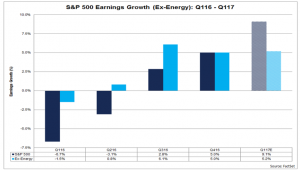

EARNINGS

Almost all of the SP500 companies have now reported Q4 earnings. 65% beat the mean EPS estimate and 53% beat the mean sales estimate. The blended earnings growth rate is +4.90%. The estimate at year end was for a 3.0% increase. The forward 12-month P/E ratio is now at 17.7, above the five-year average of 15.0 and the 10-year average of 13.9.

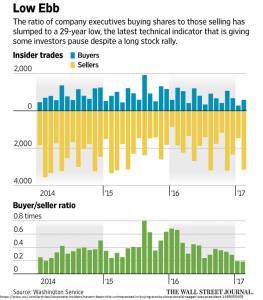

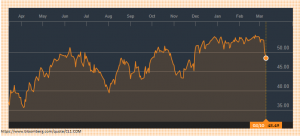

COMPANY INSIDERS

Insider buying has fallen to a 29-year low. There were 279 insider buys in January, the lowest number since 1988. The ratio of buyers to sellers in February also hits its lowest level since 1988.

TRADE WAR

As we have stated many times, the biggest threat to the economy is a possible trade war. Trump’s protectionist leanings are misguided and the “facts” that he relies upon are sometimes wrong. If he misplays his hand and new policies or taxes invite trade retaliation, the result will be less growth or possibly negative growth. German Chancellor Angela Merkel will be talking to Trump about that at their upcoming meeting on Tuesday, according to Der Spiegel magazine. The Spiegel article says that documents provided to Merkel label a US border-adjustment tax as a “protective tariff” and in violation of World Trade Organization rules. Responses from Germany could include higher duties on US imports, or setting up their own “border-tax” for US companies alone. Merkel also plans to call on Europe to pursue trade deals with other countries, to take advantage of the void that the US is no longer filling.

EUROPE

Economic news has been much improved in Europe recently, and their equity market trades in line with historic norms, but there is some major political uncertainty. Here is a look at what is coming up:

Dutch Parliamentary Election – March 15, 2017

The Freedom Party, an anti-EU and anti-immigrant party leads in the polls but is losing ground. The political system would make it difficult to turn that lead into a political majority. The Freedom Party would have to form a coalition with others, that would likely be difficult.

Brexit/Article 50

The break from the EU won’t be so clean. Britain must trigger Article 50 to open up a two-year window for Brexit negotiations, but political infighting is delaying the implementation of Article 50. The transition period will mean more uncertainty for Britain.

French President Election – April 23 (first round) and May 7 (second round)

Marine Le Pen is the leader of the National Front, an anti-EU and ant-immigrant party. The majority of French view the EU unfavorably. Le Pen is expected to advance to the second-round election, where polls show her losing by a wide margin. Her likely opponent, Emmanuel Macon, has been short on details but is running on a pro-EU and pro-business agenda.

German Federal Election – September 24

Recent polls show a close race between the center-right party (CDU) and the center-left (SPD). Merkel leads the CDU. If the SPD wins, they could form a coalition with left-wing parties.

HAPPY BIRTHDAY

Thursday marked the 8th birthday of this bull market. The market hit its low on March 9th, 2009 and that set off this 8-year run. The market has not had a 20% pullback since (20% is often defined as a bear market). That is the second longest stretch of all time, only the 1987 to 2000 market went longer without a bear market.

FED

The Fed has made it pretty clear in recent weeks that a March rate hike is likely. The question now shifts to how many hikes in 2017, will it be two or three? Fed voters seem split between two and three. Fed Governor Tarullo resigned effective in April, and he was likely in the two-vote camp. That would tilt the sentiment to three likely rate increases in 2017 (at this time). The latest jobs information (below) also would lean expectations to three hikes in 2017 as of now.

JOBS

Nonfarm payrolls increased by a solid 235k in February. The unemployment rate fell to 4.7%. Average hourly earnings increased by 0.2%, but the year over year change was 2.8%. Initial claims for unemployment insurance were up 20k last week to 243k, but that is a historically low number. All these data points indicate a very tight labor market and gives the Fed the go ahead for a rate increase next week.

The big negative in the report was retail. Jobs were down 26k in the retail sector, the most since December of 2012. This reflects the shift to on-line retail as brick and mortar stores continue to get hit. This will have some negative impact on the high yield market down the road.