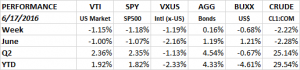

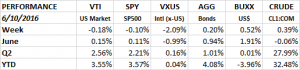

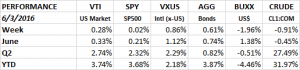

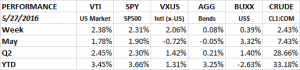

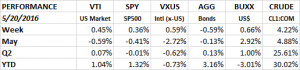

Performance

Brexit fears hung over the market as the SPY fell 1.18% (dividends included) on the week. International markets did about the same, the VXUS was down 1.19%. Bonds were up 0.16%, the US dollar fell by 0.68%.

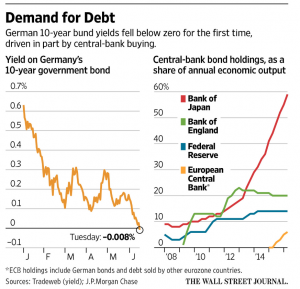

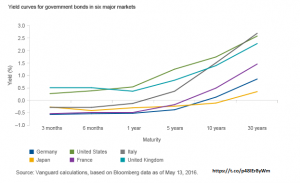

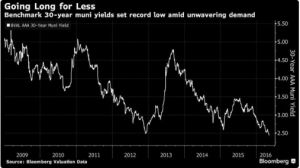

Bond yields in Europe continued to fall. The German 10-year went into negative territory for the first time. Polls at the beginning of the week leaned toward the “exit” camp but in the last day or so the have tilted back to the “stay” camp. Basically it is too close to call right now. Ultimately, an “exit” vote will have to be put into legislation. The vote is not binding although there would be enormous pressure to follow the will of the voters.

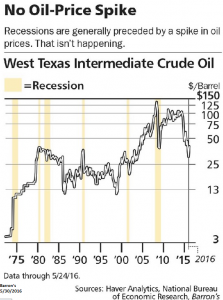

Oil was down 2.22% on the week. Rig counts have gone up for three weeks in a row.

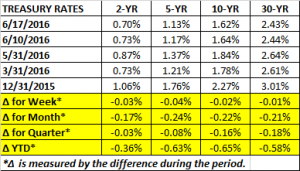

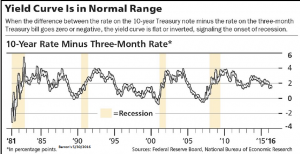

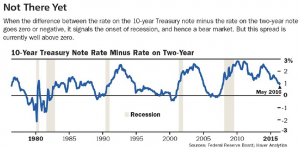

Treasury rates fell on the week. The 5-year fell 4 basis points and the 30-year dropped 1 basis point.

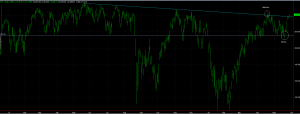

Technical Analysis

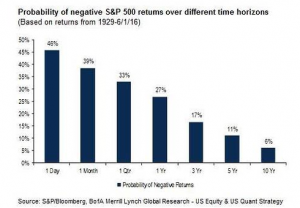

As in the five previous attempts, a failure to crack through to a new high has led to a sell-off. Helped by Brexit fears, the market is off 2.76% from its recent high on June 8th.

The market has now retraced about 60% of its gain from the low on May 19 to the high on June 8th. If the market is going to make a new high in the short run, right about here (206.52 on the SPY) would be a good place to put in a higher low and then advance. The outcome of the Brexit vote might provide the fuel in one direction or another. A “stay” vote will likely push the markets higher and an “exit” vote will send equity markets lower. The impact overseas is likely to be greater.

Earnings

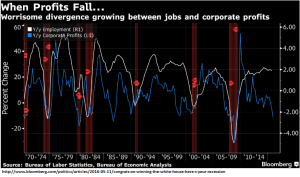

Earnings for Q2 are now expected to decline 5.1% per FactSet. At March 31, the estimated decline was 2.8%. However, earnings estimates are normally revised lower during a quarter. The trailing 5-year average is a decline of 4.4%, versus 2.30% currently. The information technology sector has been the biggest contributor to the lower estimates. Earnings estimates for the sector are now -7.3% versus -0.1% at the start of the quarter. The forward p/e for the entire SP500 is 16.4. This compares to the five-year average of 14.6.

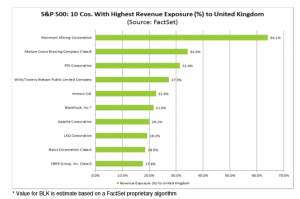

Brexit impact on SP500

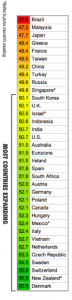

The Brexit vote takes place on Thursday. According to data compiled by FactSet, the aggregate revenue exposure of the SP500 to the UK is 2.9%. The UK represents the third highest country-level revenue exposure. The US is at 68.8% and China is at 4.9%. Thirty SP500 companies get more than 10% of their revenue from the UK.

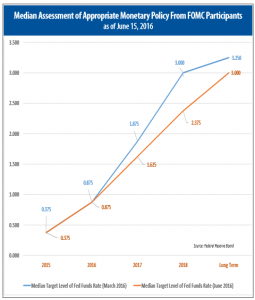

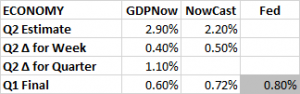

Fed

The Fed released their latest version of the dots plot at their meeting this week. The “dots plot” is the Fed Governors estimate of the future path of interest rates. Eleven participants called for two rate hikes this year and six called for one rate hike. The estimate for this year is 0.875%. The 2017 estimate is now 1.625% versus 1.875% in March, implying three rate hikes. For 2018, the estimate is now 2.375% versus 3.00% in March, also implying three hikes. The long term median estimate fell by 25 basis points to 3.00%. James Bullard of the St. Louis Fed thinks the FOMC should hike one time this year and then leave rates stable for two years.

Economy

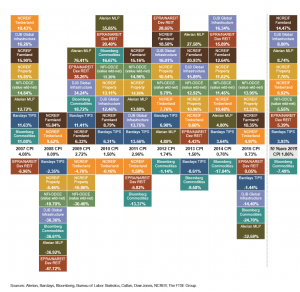

The consumer price index (CPI) was up 0.2% in May and is up 1.0% year over year. Energy prices rose 1.2%. Food prices fell 0.2%.

Core CPI increased 0.2%. Shelter rose by the biggest amount since February of 2007, up 0.4%. Apparel prices jumped 0.8%. Medical services increased by 0.5%. Medical care commodities fell 0.2%. Year over year core CPI is up 2.2%.

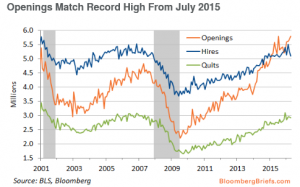

Core service inflation hit the highest year over year rate since September of 2008, rising by 0.3% for the month and 3.2% year over year. Given the current tight labor market, higher wages will begin working their way through the pipeline and probably push service prices higher in the near to intermediate term. So while inflation might be slowing building in the system the Fed is reducing estimates for the future path of interest rates.

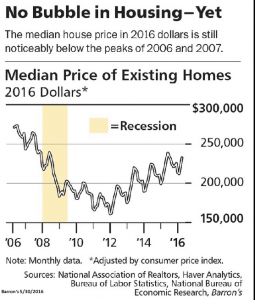

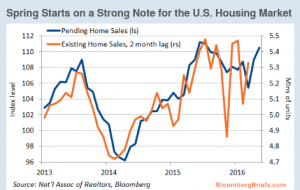

Housing starts fell slightly, by 0.3% in May. Starts have been stable at around the current 1.164 million annual rate for the last year. Building permits rose by 0.7%.

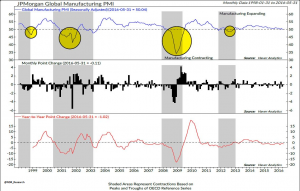

The Philly Fed General Business Activity Index increased to 4.7 in June, reflecting moderate expansion in factory activity. But the Empire Services Business Activity Index dropped 2.3 points to 3.2, indicating slightly slower activity.

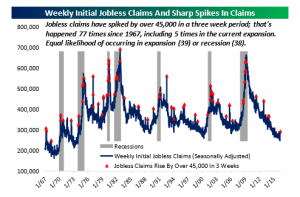

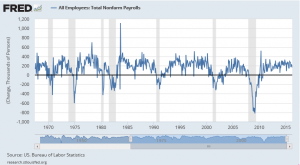

Jobless claims rose to 277k, the first increase in five weeks.

Retails sales were up 0.5% for May. Over the last two months, retail sales are up 1.73%. That is the strongest two-month performance since April of 2014.

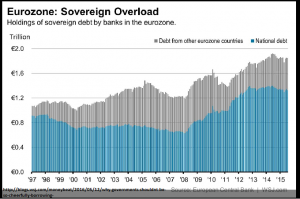

Demand for Debt

The yield on Germany’s 10-year bond dropped into negative territory. As of Tuesday it was yielding -0.008%. There is now about $10 trillion in global sovereign debt with negative yields. Corporate debt is also at ridiculously low yields. A Unilever 2020 bond now yields -0.02%. Toyota Finance issued $186 million (in yen) of three year notes yielding 0.001%.

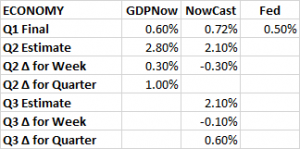

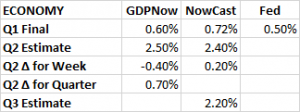

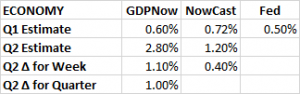

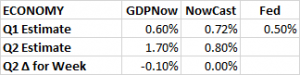

GDP Estimates

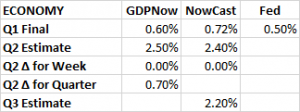

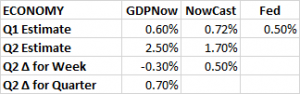

The Atlanta Fed’s GDPNow increased their Q2 GDP estimate by 0.30% to 2.80% due to improved forecasts for real consumer spending growth and real residential investment growth. The NY Fed’s NowCast decreased by the same amount, falling to 2.10%.

Summary

This week should be all about the Brexit vote. Equities fell slightly last week. German 10-year bonds went negative. The outcome of the vote will likely determine the near term direction of the market. As has been the case for a long time, economic data was mixed as the economy continues in slow growth mode.