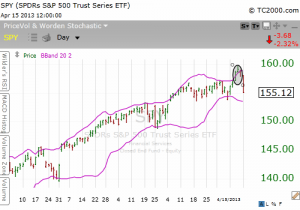

Market ends down for the week

The market ended down 2.1% for the week, hit by weak profits, falling commodity prices, fears about China, and the Boston Marathon bomber.

Highlights from Barron’s Big Money poll

1. About 1/3 of money managers expect the DJIA to get to 16,000 by the middle of next year.

2. 74% of managers consider themselves bullish or very bullish through December of 2013, this is a high percentage.

3. 86% are bullish on stocks for the next 12 months.

4. 94% like what they see for the next five year.

5. Managers are skeptical about gold, bullish on commodities longer term. Bonds and cash have few fans. Europe is out of favor.

Gold Miners

Barron’s ran a piece by Andrew Bary this week writing that gold miners are so hated that now might be a good time to get in, echoing our comments of April 15.

BDCs

Barron’s also wrote about business-developments companies (BDCs) this week. Both Ares Capital and Golub Capital, two companies we like, were listed in a table titled “Best Bets on BDCs”.