Here is the link to the graphs where we chart the new cases for Covid-19 in China, South Korea, USA, NYC, Florida, Broward County, and Italy.

Click on the Graphs tab.

Here is the link to the graphs where we chart the new cases for Covid-19 in China, South Korea, USA, NYC, Florida, Broward County, and Italy.

Click on the Graphs tab.

MARKET RECAP

Stocks were up for the week by 10.74% in the US and 10.07% outside the US. On Monday, the Fed stepped in and said it would buy unlimited amounts of Treasury and mortgage bonds but the market shrugged it off, investors were more concerned that Congress did not seem close to passing a relief bill. Stocks fell by 2.84%. But that all changed on Tuesday, as stocks had their best day since 1933 as stocks soared by 9.48% on hopes that a massive stimulus deal was close to passing. Treasury Secretary Mnuchin and Democratic leader Chuck Schumer announced they were close to finalizing a deal. The rally continued on Wednesday (+1.30%) and on Thursday (+6.07%) before falling on Friday by 3.19%.

The three-day rally from Tuesday to Thursday was good for a 17.74% advance in the overall US stock market. But if you measure from the Monday low to the Thursday high, stocks shot up by 20.22%. It was the best three-day run since October 5 to October 8, 1931, when the Dow was up 22.33%. That is not the kind of company you want to keep, as that was in the heart of the Great Depression. From that point in 1931, the market went up another 10.4% until November 9 (up by 34.81% from October 5) and then stocks would fall by 64.71% until the Dow bottomed on July 8, 1932.

On Friday, Congress passed and the President signed a $2 trillion dollar federal relief package. That represents about 9% of GDP and its purpose is to keep some semblance of economic stability for the next few months. There will need to be more in the coming months.

The shutdown of the economy is a shock we have never experienced before. In the first week, unemployment claims went from 271,2000 to 3.28 million. There will millions more let go in the coming weeks.

Are we headed for a depression? The 1930s never saw any kind of government help especially like we are seeing now. With government support, the odds of a depression would be less, but we have never seen a forced shutdown of the nation. In a worst-case, if this virus keeps the nation and the world shut down for quarters, rather than weeks or a month or two, it cannot be ruled out.

We are going to take the positive view that the country will peak out in new cases sometime in April, cases will ramp down along the same timeline that they ramped up, and then widespread testing, tracing, quarantines, social distancing, and other common-sense measures can keep the virus under control at the same time the country, or at least parts of the country, can get moving again. And, more importantly, we get saved by science in the form of therapeutics and then a vaccine. That, plus government support, avert the worst and get the economy moving again.

Former FDA Commissioner Scott Gottlieb wrote this on Twitter on Saturday, “April will be a hard month but we’ll get through it. This will end. We need to stick with current strategies. We can look toward May as a month when we carefully transition to a new posture. For now, [the] focus must be on supporting healthcare systems, preserving life, ending epidemic spread,”

How long the nation is sidelined and how long it takes to get the virus under control will be the major determinants in when we can begin to recover and how long that will take. While it now seems like any recovery would be measured in years, civilization has often surprised. This is what John Stuart Mill wrote in 1848,

“What has so often excited wonder, is the great rapidity with which countries recover from a state of devastation, the disappearance in a short time, of all traces of mischief done by earthquakes, floods, hurricanes, and the ravages of war. An enemy lays waste a country by fire and sword, and destroys or carries away nearly all the moveable wealth existing in it: all the inhabitants are ruined, and yet in a few years after, everything is much as it was before.” John Stuart Mill, Principles of Political Economy, 1848

The number of new cases, which is the key metric to plot the growth of the disease, seems to have plateaued in Italy at around 5,500 to 6,000 cases per day for the last week. If the stay-at-home measures that are in place in Italy are working there, and if the experience of Korea and China holds, there should be a consistent decline in new cases soon.

In New York, it is too early to say if the peak has been reached but the new case count has not expanded in the last few days.

But cases in the USA and Florida continue to increase.

On the therapeutic front, many companies, universities, and research labs are working around the clock to develop drugs to help. As an example, Regeneron Pharmaceuticals (REGN) has identified antibodies that could neutralize the virus. Clinical trials should start in June. Roche (RHHBY) already has clinical trials underway for an existing drug called Actemra. Abbot Labs (ABT) announced a test that can detect Covid-19 in five-minutes. These are just a few examples.

On the investment front, in regards to equities, we would lean towards high-quality companies with strong balance sheets, consistent earnings over time, and high return on equity. Equities that are in a position to benefit from a stay-at-home nation can also be considered. Contact us with any questions.

SCOREBOARD

HIGHLIGHTS

MARKET RECAP

Stocks lost $4.3 trillion in value, and are now down by $12 trillion since the start of the bear market on February 14, according to Wilshire Associates. The S&P 500 was down 14.55% last week and is now off 32.23% from the high. The overall US stock market as measured by the Vanguard Total Stock Market Index (VTI) was down 15.26% for the week.

Last Sunday, the Fed announced they would cut interest rates to 0% to 0.25%, essentially as low as they can go without going into negative territory. Trump acknowledged that a recession might be on the way. Stocks then fell by 11.38% on Monday. Stocks rallied on Tuesday as the Fed began to try to help the debt markets to function better. Equities were hit hard on Wednesday, down by 5.76%, as stocks, bonds, and commodities all fell in unison in a race to raise cash. The Dow fell to below 20,000 for the first time since the beginning of 2017. Stocks had a small rally on Thursday, up 0.74%, after central banks put into place a series of measures to help the global economy. On Friday, stocks fell by 4.08% and closed at session lows as investors worried about exploding jobless claims and Goldman Sachs said Q2 US growth would fall by 24%.

Oil fell during the week to less than $20 per barrel.

The economy has essentially been brought to a “sudden stop” as hotels, restaurants, schools, and many other “non-essential” businesses have been closed. Social gatherings of more than a few been eliminated. In the span of a couple of weeks, we have become a stay-at-home nation in the attempt to slow down the spread of the Covid-19.

This is an experiment that has never been tried before, and it remains to be seen what the consequences are, but the stock market is not waiting to find out, assuming the worst, and then later thinking, it will be worse than that. A recession is almost definite and some are even mentioning the “D” word.

Unemployment claims hit 281,000 last week, which is up from 211,000 the week before. We have been close to 50-year lows on claims for a long-time, but this spike is just the beginning. There will be an avalanche of layoffs on the way. Treasury Secretary Munichin said unemployment could eventually hit 20% without government intervention. Other economic indicators were worse, the NY Fed Empire Manufacturing index fell to -21.5 from +12.9 in February, the biggest drop ever. The Philly Fed diffusion index for current activity fell to -12.7 from +36.7 last month, the lowest reading since 2012.

The Fed has been trying to do all it can, cutting interest rates, and trying to support the debt markets, but even treasuries have been falling in price of late. Interest raises have been rising, possibly due to the deficits that every country around the world is about start financing on a scale never seen before. Congress has already passed an $8.3 billion public health spending bill, followed by another $100 billion dollar bill for free virus testing and expansion of paid sick leave, and they are now working on a trillion-dollar-plus deal.

But for the most part, investors don’t see it as enough.

What happens when you close down large parts of the economy? We are about to find out. In the past, outside of the Great Depression, drops of 30% in the stock market have been good buying opportunities. But it feels like there is a lot more downside.

There is no playbook for this. The US has never voluntarily shut down large parts of the economy for a virus. Not in 1918 for the Spanish flu or any of the others. The government is attempting to do all it can, although no one has articulated a clear plan, other than throwing as much money as possible at the problem. Of course, one of the long-term problems is that the government doesn’t have any money to throw. We will be adding trillions to the already out of control debt. So ready or not, Modern Monetary Theory, the darling of the ultra-left, is about to get a real-time tryout.

What happens going forward is a function of what letter type recovery we have. If we get a “V”, then we have a somewhat quick recovery and before you know it, we are back to where we were and then beyond. A “U” would imply whenever we hit bottom, we stay there for a period of time (maybe extended time) and then ramp up to where we started. An “L” would be the more negative scenario, where we stay at a diminished level of economic output for a much longer time.

Last week we wrote that the country needed to take tougher measures to get the virus under control. We moved in that direction in a big way this week. That is what it will take to “flatten the curve”. Once China peaked out, the number of new cases began to decline daily (as if you are looking at a bell curve), and if the numbers are too be believed, there are relatively few new cases at this point. Time will tell if China can keep the numbers down.

If the US is fortunate enough to get to peak new cases in the next 10-days, we would next be on the downside of the curve, and then we can slowly begin to get back to a normal existence faster than almost everyone now believes. I may be way off base here and much too optimistic, but let’s hope. Some areas, like NYC, where there is a big breakout, might need longer. It took 50-days of quarantine in Wuhan to break the virus.

Whenever the US attempts to begin to get life back to normal, there has to be a rigorous test and trace program. South Korea set the standard (see above). Any sign of symptoms requires a test, and if positive, immediate quarantine, and then a trace of any possible contacts. The country needs a massive education program on how to wash hands. Any public business or place needs to have hand sanitizer readily available. We must practice social distancing and have regular temperature checks. We need to follow common sense. That is the only way to help keep the numbers down once we begin to dig ourselves out of this and until therapeutics and a vaccine are ready. With all of that, we can begin to return life to normal sooner rather than later.

SCOREBOARD

HIGHLIGHTS

MARKET RECAP

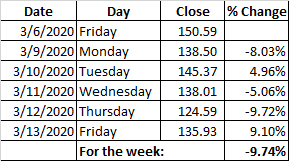

Stocks got hammered again, falling by 9.74% in the US and international markets dropped by 13.74%.

(price of VTI – Vanguard Total Stock Market Index)

The week did not get off to a good start. The price of oil collapsed on Monday after Saudia Arabia and Russia got into an all-out war for market share, each trying to max out on production. Oil prices went into a tailspin and the equity markets followed, fearful of mass defaults on loans to the energy sector in the US. Stocks in the S&P Energy sector fell by a stunning 20% on Monday and by 8.03% overall. Energy prices were already way down from the coronavirus but this was another shock at the wrong time in the wrong place. West Texas Intermediate fell 25% to $31.13 per barrel and Brent Crude, the international benchmark, dropped 24% to close at $34.36. It was the biggest decline since the Persian Gulf War in 1991.

On Tuesday and Wednesday, stocks traded gains and losses, up by 4.96% on Tuesday followed by a 5.06% loss on Wednesday.

On Thursday, stocks suffered their biggest loss since the crash of 1987, falling by 9.72%. Aside from 1987, there were only three other days where the market suffered a bigger fall, and they were all in 1929 (10/28/29, 10/29/29, and 11/6/29). That put stocks officially into a “bear” market, a decline of 20% or more. At the Thursday close, the Vanguard Total Stock Market Index fund (VTI) was down by 27.44% from the February 14 high. The US started to shut down on Thursday as some schools, Disneyland, and the NBA all announced closures.

Markets rallied by 9.10% on Friday as Trump declared a National Emergency and was close to a deal with the Democrats on a relief package. Trump’s declaration of a national emergency opens up access to $50 billion in financial assistance for states and localities. The Fed said it would buy $33 billion of bonds to improve the functioning of the markets and would make $1.5 trillion of short-term financing available. As of the close Friday, stocks were down by 20.83% from the high and down 16.92% year-to-date.

LIFE IS CHANGING FAST

Italy which has been hit hard has basically shut down for a few weeks. Trump announced a ban on flights to and from Europe. Europe has become the new epicenter of the disease and the US is probably not far behind. All of the major sports leagues and the NCAA have postponed or canceled their seasons. Schools in at least 12 states, including Florida, are going to be closed for a few weeks, and public gatherings of more than 200 or so are either prohibited or are being canceled. The aim is to “flatten the curve” so that Covid-19 cases don’t pop in such a manner as to overwhelm the health care system.

While the measures above may seem tough, they are probably not enough. A full lockdown of the country (except for essential type businesses) similar to what China did, will probably be necessary to stop the virus in its path. And the US will have to act fast before it becomes too late. Cases in the US will begin ramping up immediately if we follow a similar path to China (see graph below). But China has shown the path on how to get the virus under control.

APPLE CLOSES ALL STORES OUTSIDE OF CHINA

Apple announced they will close all stores outside of greater China until March 27th. Tim Cook, Apple CEO, said that “the most effective way to minimize [the] risk of the virus’s transmission is to reduce density and maximize social distance.” The fact that stores will be open in China, but closed outside China, tells you all you need to know about how successful China has been in, at least so far, turning the tide on Covid-19.

While the virus started in China and was exploding there, so far about 80,000 plus cases, from the time new cases had reached 250+ on January 23, China peaked in new cases only 17 days later on February 10th, and remarkably, has been declining ever since. There have been less than 40 new cases reported in China every day since Tuesday, with only 11 on Friday and 18 on Saturday. China has shown the virus can be beaten and in short order. That is the bright spot that shows it can be done. That is the path the US needs to follow.

It remains to be seen if China can keep the numbers down as they return to normalcy. But for now, the turnaround is nothing short of remarkable and the US and the rest of the world will have to learn from China’s success. That will require quick action which at least for now, doesn’t seem like it is coming. There are a lot of half-measures now in place in the US but it will take a full-court press to beat down the virus.

THE WORLD IS NOT COMING TO AN END

While there is a feeling of panic in the streets (and the markets), we don’t think the world is coming to an end. Although life and financial markets can get much worse before they get better. China (as well as Korea) have shown that the virus can be brought under control. Furthermore, this is not the first pandemic. We wrote a couple of weeks back about the Spanish Flu, the Asian Flu, the Hong Kong Flu, and SARS and they all eventually faded. While Covid-19 is probably the worst since the Spanish Flu (1918), at some point there will be therapeutics and a vaccine to knock it out, and until then, there will be lots of tough adjustments to life. Fast and strong measures can work. China and Korea have shown that. China seems to have turned around the growth of the virus in less than a month, time will tell if it can keep it down, but so far it is encouraging. Governments around the world will be pouring in billions, probably trillions, to support their economies. Once the turn in the virus happens, we are hopeful that economic growth will quickly rebound.

During past flu scares, governments never took the kind of actions we are seeing today. So how this plays out economically is an unknown. There is a legitimate worry that there is too much corporate debt out there, and a weak economy will throw a lot of companies overboard. The near-term economic future is unknown and will get worse before it gets better. While we would hope for a V-shaped economic recovery, there is the risk of a U shaped recovery, where the economy falls and then goes sideways for a while, and then increases back to normal.

But these are the kinds of moments that the legendary investors have taken advantage of in the past. As Baron Rothchild famously said in the 18th century, “the time to buy is when there is blood in the streets.” He learned that from the Battle of the Waterloo against Napoleon. If history is any guide, unless we are going to go into a Great Depression, investors with a long-term focus and that are not overallocated to equities for their risk tolerance (consult a financial advisor) should consider taking advantage of this sell-off. We would not be jumping in all at once, to be clear, stocks can certainly decline a lot more from here, but small purchases here and there in financially strong companies, now and as the market declines further should work out over time. Of course, there are no guarantees. No one knows what the future of the stock market holds, but buying at times when it hurts the most has usually worked out.

SCOREBOARD

HIGHLIGHTS

MARKET RECAP

US stocks advanced for the week by the thinnest of margins, +0.1%, but it didn’t feel that way as stocks were way up or down every day. International stocks fell by 1.19%. Here is how it broke down day by day in the US:

The momentum from the late market rally from the prior Friday continued on Monday with the 4.14% advance. But that was reversed on Tuesday as the market fell late as the Fed was holding its news conference announcing a 1/2 percent interest rate cut. News of Joe Biden’s Super Tuesday performance helped the market rally by 4% on Wednesday. Then coronavirus fears dropped the market on Thursday. Friday was more of the same but stocks rallied 2.36% off of their lows late in the day to close down by 1.86%. Add it all up and stocks were pretty much flat for the week.

The wild ups and downs reflect the fact that no one knows how bad the virus will be and what will be the ultimate impact on the economy. Economic numbers that were reported this week were good, and show a US economy that is improving. The Atlanta Fed’s GDPNow model raised the Q1 estimate of growth to 3.1% from 2.7%. It was a blockbuster jobs report as nonfarm payrolls increased by 273,000 (the estimate was 175,000) and the unemployment rate dropped to 2.5%. December and January’s numbers were revised up by 243,000. But most of the survey was done before the coronavirus accelerated in the last couple of weeks. No one expects anything close to that for the next few months.

INTEREST RATES FALL HARD

The Fed on Tuesday cut interest rates by one-half point to a range of between 1% and 1.25%. It was the first time since 2008 that the Fed cut rates in between scheduled policy meetings. The market immediately sold-off on the news, probably realizing a rate cut would have minimal impact on the supply-side shock to the economy. Meanwhile, interest rates plunged. The 3-month treasury bill now yields 0.45%, which is down from 1.27% last week and 1.55% at the end of last year. The two and ten-year yield fell by about 37 and 39 basis points for the week. The 10-year yields an all-time low of 0.74% and the 30-year is at 1.66%. High-yield bonds are now at 5.05%, up from 4.62% last week. The falling interest rates indicate fixed income investors expect some bad times ahead.

ADVANTAGE TO STOCKS BASED ON YIELD

The differential between the yield on the S&P 500 and the 10-year treasury are now at the highest levels since 2008. That doesn’t mean the bottom is in but stocks are attractive based on this valuation measure.

BIDEN IS THE ODDS ON FAVORITE

Biden’s surprise surge on Tuesday has vaulted him to be the front-runner for the Democrats according to fivethirtyeight.com. Along with the Tuesday performance, all of the remaining candidates have dropped out, giving Biden has an 89% chance of winning the Democratic nomination.

VIRUS

The coronavirus continues to spread but while absolute numbers are still small. the economic impact will be big. According to Johns Hopkins, there have been 107,000 confirmed cases as of Sunday morning and about 3,600 people have died. In the US, there are 440 cases over 32 states. The fear factor and efforts to minimize the spread of the virus are beginning to have a real economic impact. Cases in the US will probably skyrocket over the coming days just because testing will be going up dramatically.

SCOREBOARD