The SPY dropped 1.62% and the DOW dropped 264 points. The market closed at its lows for the day. So is this the beginning of a long awaited correction? Maybe. But lots of people including me have thought that many times in the past.

But in the short-term this might be a buying or trading opportunity. I am not predicting that but will bring up something we have written about in the past, and that is the pop in the VIX.

Not surprisingly, when the market falls hard like it did today, the VIX will have a big move to the upside. Today it burst up by over 20% to close at 16.00. That puts the VIX two standard deviations above its mean when measured over a 20-day period. In the past, that has been a buy signal.

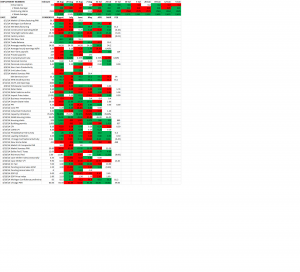

Here is how it has worked out over the last year:

| DATE | SPY Close | SPY +5 days | Percent | SPY +10 days | Percent | |

| 7/31/2014 | 193.09 | 191.03 | -1.07% | 195.76 | 1.38% | |

| 7/17/2014 | 195.71 | 198.65 | 1.50% | 193.09 | -1.34% | |

| 4/11/2014 | 181.51 | 187.04 | 3.05% | 186.88 | 2.96% | |

| 3/13/2014 | 185.18 | 187.75 | 1.39% | 185.405 | 0.12% | (dividend adjusted) |

| 1/24/2014 | 178.89 | 178.18 | -0.40% | 179.68 | 0.44% | |

| 12/2/2012 | 178.13 | 181.49 | 1.89% | 184.83 | 3.76% | (dividend adjusted) |

| 10/3/2013 | 167.62 | 169.13 | 0.90% | 173.22 | 3.34% | |

The average 5-day return has been 1.04% and 1.52%. More impressive is that several of these signals have been good entry points over the longer run. If the market fails to have some kind of positive reversal that might be a signal that a correction is beginning, or it might not! That is the market (and why it is usually better to focus on the long run).