MARKET RECAP

Fed officials are getting close on an agreement to begin a tapering program in a few months. An end-date hasn’t been set yet, but some Fed officials are pushing for mid-2022.

Businesses around the world are sitting on a stockpile of $6.84 trillion according to S&P Global. This is based on second-quarter earnings reports. That is up by 45% from five years ago and 2.6% greater than last quarter. Despite being flooded with cash, corporate spending is expected to decline by 5.8% this quarter, down from 12.9% last quarter. Many companies are holding on to cash until the virus clears. Part of the cash buildup was due to dividends cuts and cancelations of share-buyback programs. Then you have huge amounts of debt being raised to take advantage of low interest rates.

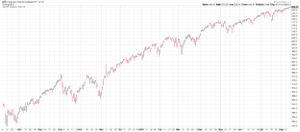

SCOREBOARD