MARKET RECAP

Stocks fell for the week by 2.78% in the US and 0.61% outside the US. Bonds rallied by 0.18%, oil fell by 3.36%.

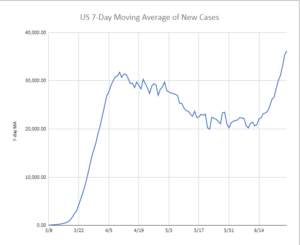

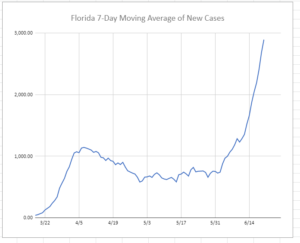

A big reason for the US selloff was the dramatic ramp-up in Covid cases as a record number of infections have been recorded. Infections across the US are up by 65% over the past two weeks.

The stress test results on banks, released by the Fed on Thursday, did not help. Buybacks were suspended and dividends were capped for the third quarter. The Fed also said that future dividends would be dependent upon earnings, couple that with an expanding virus, and financial stocks lost investors’ interest as the week closed. Investors also have to start or have started to price in the chance of a Democratic sweep in November.

Raw material prices have been increasing, a sign that the supply/demand curve is shifting in favor of producers. Raw material prices tend to move in real-time based on supply and demand and increasing prices indicate that the recovery might be ahead of what was anticipated. The raw material prices reflect increased economic activity around the globe, but the surge in the virus might slow down those gains.

The increase in raw material prices might be reflective of the improved purchasing managers index scores as reported by IHS Markit. The US composite measure came in at 46.8, the highest score in four months. A score of less than 50 is contractionary, but the trend is positive. In the eurozone, the composite score was 47.5 in June compared to 31.9 in May.

Gold prices are nearing all-time highs. There are several factors at work. Given ultra low-interest rates, it is more attractive to now hold gold given it does not pay interest. In addition, new fears about the rising virus count might indicate more government spending, which could devalue global currencies.

SCOREBOARD