MARKET RECAP

- US stocks were flat for the week, although the Nasdaq managed a 1.4% advance, helped by blockbuster earnings by Nvdia. The Dow fell by 2.33%.

- The Dow had its worst day of the year on Thursday, falling 600 points, on inflation worries after solid numbers in a manufacturing survey. The index closed below the 40,000 mark at 39,069.

- Target fell 8% on Wednesday as sales declined for the fourth quarter, but TJ Maxx and Ross have had positive reports.

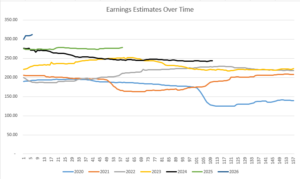

- Earnings estimates have been rising; the SPX is expected to show an 11% increase in 2024 and 14% in 2025.

NVIDIA

SCOREBOARD