HIGHLIGHTS

- Markets burst higher.

- Equities might be in a “blow-off or melt-up” phase.

- Technical indicators show an overbought condition rivaling the mid-80s and late 90s.

- Solid labor market conditions.

MARKET RECAP

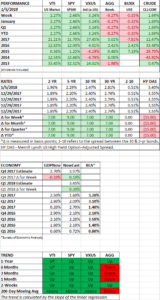

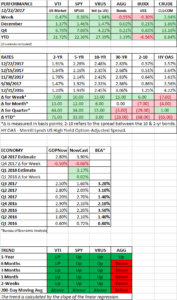

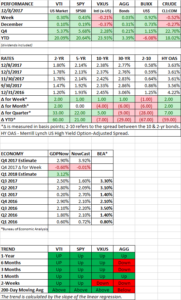

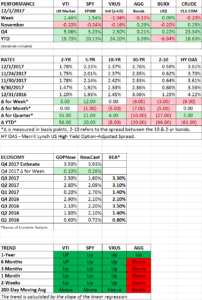

Stocks burst out of the gate to start 2018 as US equities increased by 2.27% and international equities were up 3.24%. It was the best opening week since 2003. The Dow broke through the 25,000 mark. It took only 24 trading days from when the index cracked 24,000. Of course, moving a thousand Dow points is not what it used to be, at least in percentage terms, but remarkable nonetheless.

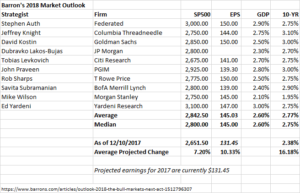

Synchronized economic growth around the world, lower US taxes, improving corporate earnings, low inflation, low-interest rates, and investor enthusiasm has created a powerful mix that pushes the market up and up despite valuations getting to historically high levels.

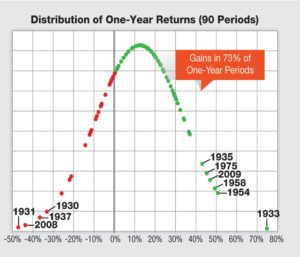

Noted investor and market historian Jeremy Grantham summed it up in his recent piece, “I recognize…that this is one of the highest-priced markets in U.S. history. On the other hand, as a historian of the great equity bubbles, I also recognize that we are currently showing signs of entering the blow-off or melt-up phase of this very long bull market.”

In other words, there might be a lot more to run in this bull market, but at some future point, valuations will begin to revert to their mean, or worse.

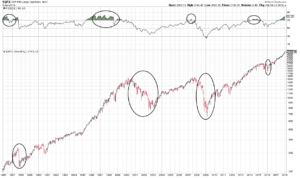

OVERBOUGHT MARKET

Looking at some technical indicators, the market is overbought. The Wilder’s Relative Strength Index takes a measurement of the speed and change of price movements over a period of time. A measure over 70 is considered overbought. A monthly chart of the S&P 500 and the Wilder’s Relative Strength Index over a period of 21 months, dating back to 1985, shows an overbought condition comparable to 1986-1987 and the late 1990s. Both periods were followed by bear markets. It is important to note that the oversold condition in the 1990s started about 5-years before the bear market of 2000.

We are not anticipating a bear market in the very near term. Economic conditions in the US appear solid, earnings are increasing and there is worldwide growth. You can often find many indicators that will tell you why the market will crash tomorrow, but the market is overbought here from a technical perspective.

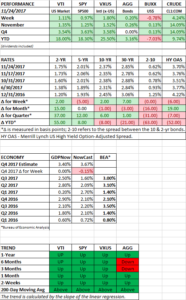

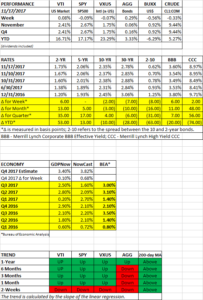

ECONOMY

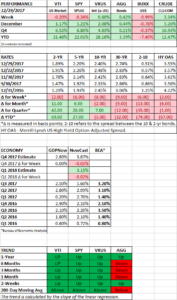

The Atlanta Fed’s GDPNow has Q4 growth estimated at 2.7% and the NY Fed’s Nowcast is at a very strong 3.97%.

Nonfarm payrolls were up by 148,000 in December, lower than recent months. The unemployment rate remained the same at 4.1% and the average workweek also stayed the same at 34.5 hours. Average hourly earnings were up 2.5% year over year. Overall, tight conditions continue to prevail in the labor market.

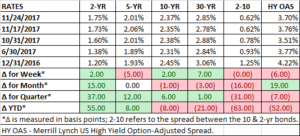

SCOREBOARD