HIGHLIGHTS

- US equities up by 0.30% to hit a new high.

- Bitcoin futures launch today after a wild week.

- Wall Street strategists all project higher US market in 2018 in Barron’s Outlook.

- Nonfarm payrolls up by 228,000 in another strong labor report.

- Congress extends deadline on the debt ceiling for another two weeks.

PERFORMANCE

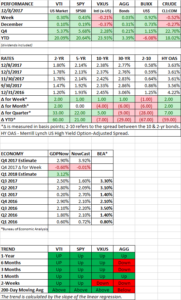

The market dipped on Monday and Tuesday but rallied just enough over the remainder of the week for US equities to hit new all-time highs. The US markets were up by 0.30%. International markets fell 0.21%. Bonds were flat and the dollar advanced by 0.92%.

BITCOIN

Bitcoin futures trading begins today (Sunday, December 11) at the CBOE Global Markets Exchange. Later in the month, the CME Group launches its own bitcoin product. And then the NASDAQ will launch early next year. The futures are set to settle in US dollars, not bitcoin.

The talk of bitcoin is now everywhere and the consensus by the old-timers is we are watching a bubble in the making. Judging by the chart, it sure looks that way. From Monday to Thursday, the price rose by 53%, only to fall by 22% two days later. Depending on your perspective, buying bitcoin is akin to “investing” in past manias such as Dutch Tulips, or maybe like Beanie Babies (on a much grander scale). To others, bitcoin represents the future of currency and just about everything else.

WALL STREET FORECASTS

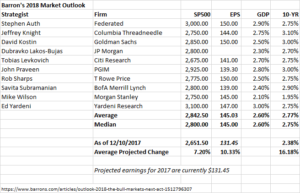

Barron’s interviewed 10 investment strategists for their 2018 forecasts. None of the ten forecast a fall in prices in 2018. Tobias Levkovich from Citi Research is forecasting a flat market. He projects a 2018 price of 2675, just about 24 points from here. All of the others are more on the bullish side. At the high end is Ed Yardeni, forecasting a price of 3100. The projection calls for a 7.2% gain, fueled by higher projected earnings of about 10%. But those earnings increases are counting on a tax cut worth about $10 in earnings. Take out the tax cut and earnings would only be estimated to increase by about 3%. The strategists also forecast an increase in the 10-year treasury rate to 2.77%, up from the current 2.38%.

Last year the group projected the S&P 500 to end 2017 at 2380, that turned out to be much too low (barring any major sell-off in the final few weeks of the year).

Fears that the strategists cited include inflation, aggressive rate increases by the Fed, regulations against social media companies, and a bitcoin crash.

LABOR MARKETS

Labor markets continue to show strength. Nonfarm payrolls were up by 228,000. The average workweek increased by 0.1 hours to 34.5 hours. The unemployment rate remained steady at 4.10%. Average hourly earnings moved ahead by 0.2% and the year over year change is now at 2.5% compared to 2.3% last month.

SPENDING BILL

The House and Senate both passed a bill that provides funding for the US government for another two weeks.

SCOREBOARD