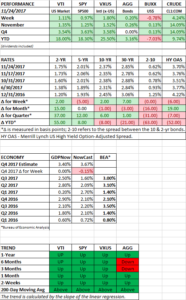

PERFORMANCE

US equities set new highs as the market was up 1.11%. The S&P 500 closed just above 2600. International equities increased by 1.80%, also a new high. Synchronized economic growth around the world and strong corporate earnings have provided fuel to move prices higher.

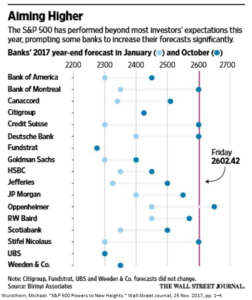

Stock prices have run well ahead of analysts’ forecasts from the beginning of the year and even as recent as a few weeks ago. In the chart below, the light blue dot represents the January forecasted price and the dark blue represents the newer, updated forecast (as of October). With the close on Friday, the S&P 500 has now equaled or exceeded the year-end targets for all the banks shown below except for one.

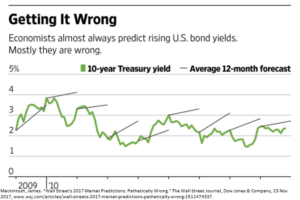

The truth is that it is difficult to make accurate forecasts. And it is not just equity prices. Look below at the track record in recent years for the 10-year Treasury yield. Economists have constantly been predicting rising yields, but they have been mostly wrong, at least so far.

YIELD CURVE

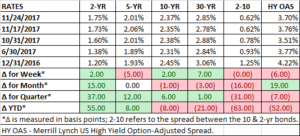

The spread between the 10-year and two-year US Treasury bonds has narrowed dramatically since the beginning of the year, down by 63 basis points (see the column titled 2-10 below). An inverted yield curve, when the near-term rate is higher than the longer-term rate, has often been a leading indicator for a recession. We are not in an inverted state yet, but we might be heading there.

However, some economists think that this time is different. “This time is different” have been dangerous words in financial history, but we have been going through some extraordinary times. Central banks around the world are still artificially holding interest rates at zero or below, increasing demand for US government debt, and thus keeping the 10-year rate lower than it would naturally be. At the same time, inflation expectations have come down, and the Fed is increasing short-term rates, putting upward pressure on the 2-year. Since the beginning of the year, the 2-year has increased by 55 basis points while the 10-year has declined by 8 basis points.

By the way, you can find the weekly update for bond rates in our Scoreboard section each week in this newsletter.

SCOREBOARD