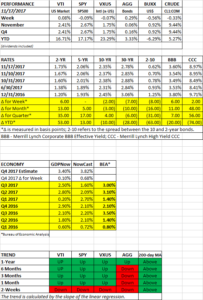

PERFORMANCE

Markets ended the week flat as US equities were up by 0.08% while the S&P 500 was down by 0.09%, international equities fell by 0.07%. In what amounts to a correction in today’s environment, stocks sold off in the first hour on Monday, Tuesday, and Wednesday, but traders bought the dip each time and the market finished close to its high on each day. The market rallied on Thursday on the House passing tax legislation and on strong earnings from Wal Mart.

CRAZINESS ACROSS MARKETS

Two examples this week of the craziness across different markets. First, bitcoin, the high flying cryptocurrency, fell by 22% and then rallied by 35% to hit new highs, all in a matter of a few days.

And then in the art world, Leonardo Da Vinci’s Salvator Mundi was auctioned off for $450 million, shredding the previous record for the amount most paid for a painting.

EARNINGS

Per Thomson Reuters, earnings for Q3 are now expected to increase by 8.2% year over year. That is significantly higher than the 3.2% estimate in mid-October. Excluding energy, the estimate is 5.9%. In the S&P 500, 72% of companies have reported earnings that beat estimates. The current forward p/e ratio is 18.2.

ECONOMY

GDP growth estimates for Q4 look solid. The Atlanta Fed’s GDPNow model has growth coming in at 3.40% and the NY Fed NowCast is forecasting growth at 3.82%.

SCOREBOARD