HIGHLIGHTS

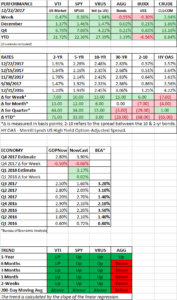

- US markets advance by 0.47% and international equities are up 1.64%.

- Treasury yields jump higher hurting rate-sensitive investments.

- Bitcoin falls 36.5%.

- Trump signs tax legislation.

MARKET RECAP

US equities hit a new high on Monday and then closed successively lower for the rest of the week, at just about the same closing price as last week. However, adjusted for dividends, prices advanced by 0.47%. International markets were up 1.64%.

The excitement was with the 10-year treasury bonds. Interest rates jumped to their highest level in nine months, closing the week at 2.48%. The rising rates had a spillover effect on rate-sensitive equities like REITs and utilities, which fell by 3.82% and 4.67%.

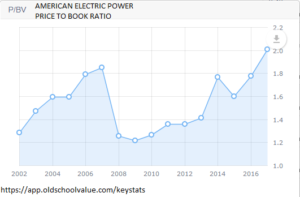

Even with the drop in utilities, many are still expensive on a historical basis. As an example, looking at American Electric Power (AEP), the stock is currently selling at a price to book of 2.0 compared to a median value of 1.60 since 2015, 20% lower than the current ratio.

While utilities have been falling, energy has been rallying. The XLE is up 16% since hitting its low in mid-August.

TAX BILL

Trump signed into law the new tax legislation. The bill is highlighted from an investment perspective by a more competitive tax rate for corporations and the repatriation of foreign earnings. A stopgap measure to keep the government funded through mid-January was also passed.

BITCOIN

Cryptocurrencies collapsed. Bitcoin fell by 36.5% from its peak one week ago.

SCOREBOARD