HIGHLIGHTS

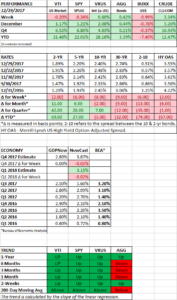

- US equities close the year with a small loss but are up 21% on the year.

- International equities are up 28% for the year.

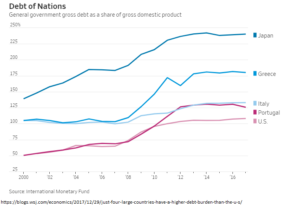

- US debt is now the fifth largest of all large countries in percentage terms.

- The Surprise Index hits its highest level in six years.

MARKET RECAP

US equities closed the year with a loss, falling by 0.20% for the week. But what a year it was, up about 21% (including dividends). Equities were on a tear all year, never falling by more than 2%. The Dow is on a nine-month winning streak, the most since February of 1959 when it had advanced for 12-months in a row. And the S&P 500’s nine-month win streak matches the nine-month stretch that ended in April of 1983. The NASDAQ Composite has now increased six-years in a row, tying the 1975-1980 period as the longest run on record.

International stocks did improve by 0.60% for the week, with a 28% advance on the year. Interest rates fell so bonds were up by 0.42%.

US DEBT

According to the International Monetary Fund, US debt now stands at 108.1% of GDP, the fifth largest amount in percentage terms of all large countries. Meanwhile, the tax bill passed last week will add another $1 trillion dollars or so in debt over the next ten years, and deficits will also increase because of structural issues (social security/medicare). At some point, the country will need to deal with this, especially if interest rates rise.

SURPRISE INDEX

The Citigroup Economic Surprise Index closed the year at its highest level in six years reflecting the best level of constant economic growth in three years. Normally, surprises on the upside lead to revising estimates higher going forward, making it more difficult to continue to “surprise”, which then leads to disappointments if the numbers come in under the estimates. Missed estimates could impact equities to the downside.

SCOREBOARD