HIGHLIGHTS

- US equities up by 1.46%, international stocks fall. Lots of volatility Friday.

- North Korea test fires a missile that threatens the entire continental United States.

- Former Trump advisor Michael Flynn pleads guilty and agrees to cooperate with the special counsel.

- The Senate passes tax legislation, now it moves to a conference committee.

- GDP growth is revised higher to 3.3% for Q3 and forecasts for Q4 are for higher growth

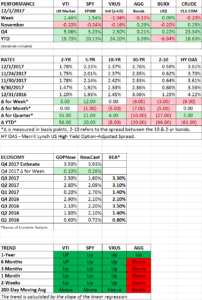

PERFORMANCE

It was a bumpier ride than normal, but the market continues to travel in the same direction, up, as US equities advanced by 1.46%. North Korea even test fired a new missile that can supposedly hit anywhere in the United States, and that didn’t shake the market advance. International markets dropped by 1.04% and the bond aggregate was down slightly by 0.13%.

Markets moved higher on progress on tax legislation. On Friday, news broke that former advisor to President Trump, Michael Flynn, was going to please guilty and cooperate with the special counsel’s inquiry regarding election interference. That sent equities into a tailspin. Stocks immediately tumbled and were down 1.6% from the open by midday. But the buy the dip mentality prevailed and the market rallied to close down just 0.2% for the day.

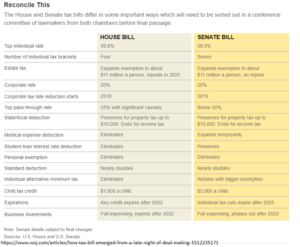

TAX LEGISLATION

Tax legislation now goes to a committee with the House and Senate. The resulting legislation, if passed, will impact almost every area of the US economy. The original hope was that tax legislation would simplify the tax system, encourage economic growth and be somewhat revenue neutral. Most likely, the end result coming out of committee will be a tax system that is more complicated, especially in terms of pass-through entities (leading to unintended consequences), $1 trillion-plus added to the deficit over the next 10-years and a questionable impact on future growth, at least according to the plan’s critics. Similar to Obamacare, there is a rush to pass legislation for the sake of just passing legislation, instead of crafting a well thought out bill that is better understood and debated.

GDP

Real GDP growth for Q3 was revised higher to 3.3% from the original estimate of 3.0%. It was the fastest growth in three years. Personal income increased by 0.4% in October. Disposable personal income rose by 0.5%, the most in eight months. Initial jobless claims came in at 238,000, a historically low number. Retail sales during the Thanksgiving holiday were good. Overall, the economy continues to look strong. Estimates of Q4 growth increased in both the Atlanta Fed’s GDPNow model and the New York Fed’s NowCast model to 3.50% and 3.93% respectively, up from 3.40% and 3.67%.

SCOREBOARD