HIGHLIGHTS

- Equities up 0.78% to close at another record.

- The tax plan is close to becoming law.

- The Fed increases rates by 1/4%.

- Disney buys most of the assets of 21st Century Fox.

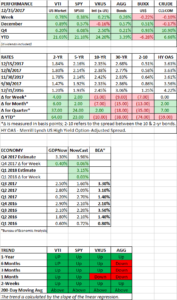

PERFORMANCE

US stocks increased by 0.78% to hit another record. International equities moved ahead by 0.21% and bonds increased by 0.26%. Higher corporate profits powered by the tax bill are getting the credit for the recent stock run. Profits on the S&P 500 might improve by $10 per share due to the tax cut. On the yield front, the 2-year rate increased by 4 basis points and the 10-year fell by 3, dropping the spread to 0.51%

TAX PLAN

Lawmakers are close to passing a $1.5 trillion tax cut. The plan does not simplify the tax system. The bill is filled with staggered dates, new rates, and complicated new provisions. The pass-through legislation will lead to unintended consequences. The bill overall will add to a deficit that the US cannot afford to make any bigger.

The legislation does have needed relief for repatriation of overseas earnings (almost $3 trillion) and a lower tax rate for corporations to make the US more competitive with other countries.

FED

In Janet Yellen’s final session as Chair, the Fed increased the federal funds rate by 1/4% to 1.25% to 1.50%. The Fed currently plans to increase rates another three times in 2018 and twice in 2019. The market is currently pricing in two rate increases, but there are some economists predicting four. In addition, the Fed has begun the process of unwinding their balance sheet.

A combination of lower tax rates and higher interest rates in the US could pose a problem to China in keeping capital at home. In response to the Fed, the Chinese central bank also increased rates, first, to slow capital flight out of China, and two, to try to tame all the leverage throughout the Chinese system. While higher interest rates might lower the appeal of taking on more debt in China, it also increases the carrying cost of current loans in the very highly leveraged Chinese system. It is a tricky balance that the Chinese central bank will have to thread.

It remains to be seen what the European Central Bank will do. But at some point, they will probably slow the pace of their bond purchases and will eventually begin to increase rates.

All the above points to a world with slightly higher interest rates and less central bank stimulus, traditionally a formula that would slow down the pace of the equity market due to a falling p/e ratio.

DISNEY

Disney bought most of the assets of 21st Century Fox for $66 billion (stock + debt – cash) in a monumental deal as it scales up to take on Netflix. Netflix currently trades at an enterprise value to EBITDA ratio of 47, compared to 10.5 for Disney.

SCOREBOARD