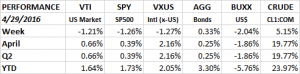

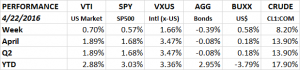

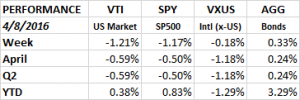

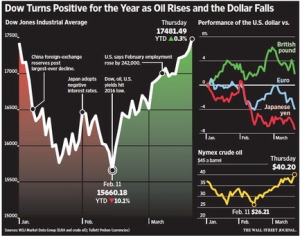

The market finally retreated. Although it was slight. The overall US market as measured by the VTI dropped 1.21%, the SP500 as measured by the SPY was down 1.26% and international x-us was down 1.27%. Bonds advanced 0.33% and the US dollar fell 2.04%.

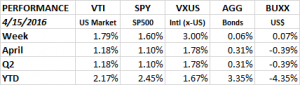

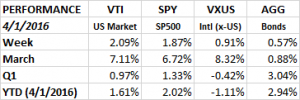

For the month, the US market was up 0.66%, the SPY was up 0.39% and international x-US was up 2.16%. Some of the tech stocks really got hurt in April, AAPL -14.0%, GOOGL -7.2% and MSFT -9.7%. AAPL now sells at less than 12x 2016 earnings, yields 2.43% and has a free cash flow yield of about 10%. Compare that to a 20-year treasury which yields 2.26%! But nobody wants AAPL right now and the stock has fallen hard.

Value, small caps and resource stocks outperformed in April. Treasuries were mostly down but the corporate investment grade and high yield markets had nice rallies. The aggregate bond index was up 0.25%. Treasury rates were up about 5 basis points across the curve. The dollar was down and oil had a major rally, up 19.77%.

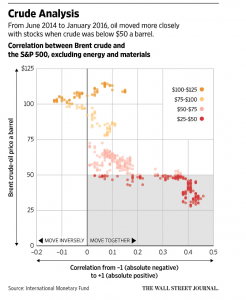

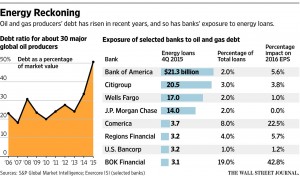

The correlation between oil and stocks did not hold this week. While stocks fell oil moved ahead by 5.15%. As we move away from $40 per barrel oil and get closer to $50 that correlation will likely begin to decline.

Year to date the US markets are up 1.64%. Bonds have been the bigger winner, up 3.30%.

EARNINGS

While earnings overall are down year over year, the reported numbers versus expectations have been better than expected. 62% of SP500 companies have reported earnings per FactSet. 74% have beaten their mean earnings estimate and 55% have beaten their sales estimate. So far, earnings are down 7.6%. The estimated earnings decline was about 9% when Q1 ended.

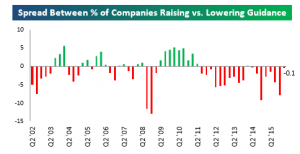

Normally, earnings estimates for a quarter decline during the first few weeks as analysts are often a little too optimistic going in, and need to readjust as the quarter begins. For this quarter (Q2), analysts have lowered earnings estimates for the SP500 companies by 1.8%. Over the last year, earnings estimates were dropped by an average of 2.8% during the first month of the quarter. Looking back over the last five years, analysts have dropped earnings estimates by 2.2% during the first month and over the last 10 years the average was a 2.3% drop. So the current estimated decline of 1.8% for Q2 is better than the recent averages.

Likewise, the spread between companies raising guidance versus lowering guidance has been almost flat. So while we would not say that earnings are going to be really good going forward, they may be better than what analysts estimate.

ECONOMY

The Bureau of Economic Analysis released their advance estimate of Q1 GDP showing slow growth of 0.50%. It was the lowest number since Q1 of 2014, when the number was negative. In past years, Q1 has been the slowest quarter of the year, if the pattern holds, growth will accelerate from here.

Private nonresidential fixed investment, or capex, fell at a 5.9% annual rate. As would be expected, investment in energy exploration was the main culprit, plunging by 86%. With oil prices on the rebound, investment in the energy sector should begin to stabilize.

Inventory to sales continues to rise. That would be a negative sign for the economy. At some point inventory levels will revert to the mean and to do so, there would likely be a drop in purchasing for a while, slowing the economy.

Autos and housing are not contributing to the economy at their historical levels. The strong job market has helped employees. Their compensation as a percentage of nominal GDP has been rising.

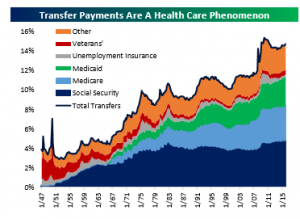

Transfer payments from the government to households continues to rise. Healthcare costs (Medicare and Medicaid, marked in light and dark blue below) are driving most of the increase. Transfer payments are now around 15% of GDP compared to about 4% in 1947.

All of this adds up to not much, in terms of growth, which is why GDP is estimated to have grown at only 0.5%.

For Q2, current estimates show a small improvement over Q1. The Atlanta Fed’s GDPNow currently shows growth of 1.80% and the NY Fed Nowcast currently forecasts growth 0.80% for the second quarter.

JOBS

The initial jobless claims number came in a 257k. Up by 9k from last week but still very low. The job market has been the one very big bright spot in the economy. The four-week moving average is at its lowest level since 1973.

HOME SALES

Pending home sales were up by 1.4% in March, higher than the consensus estimate of 0.5%. It would be a big positive if housing can begin approaching historical norms.

FED

The Fed released a statement on Wednesday. They gave no indication of when they will raise rates again and the statement was noticeable in that it did not emphasize international risks as much as previous statements. The Fed is probably looking at 1 to 2 hikes this year, with a slight chance for a June increase, although we would need some firming economic numbers and stable financial markets. The Brexit vote is just after the June Fed meeting so the Fed would also have to be confident that the “no exit” choice would win to raise rates in June.

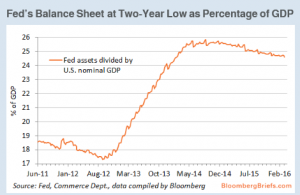

One reason why growth might be slowing is that the Fed’s balance sheet, as a percent of GDP has been declining since the end of 2014. The Fed has maintained its assets at about $4.5 trillion during that time, but as GDP has grown, the percentage to GDP has declined. The net effect is the Fed’s balance sheet has less of a stimulating effect on the economy than a couple of years back.

EUROZONE

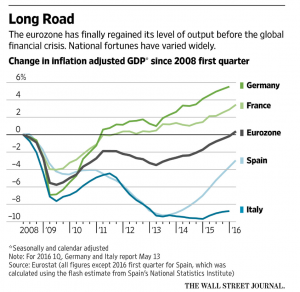

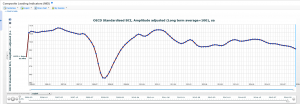

While the US is dragging along almost at stall speed, growth in Europe is beginning to accelerate. GDP in the Eurozone grew at an annualized pace of 2.2% in the first quarter, increasing at a rate of 2x the previous quarter. Inflation adjusted GDP has finally surpassed the 2008 level. However, economists are only expecting growth of 1.6% for the entire year.

SUMMARY

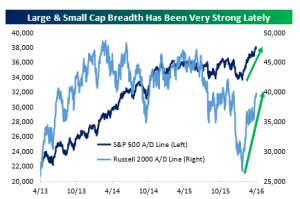

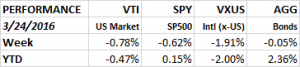

We did get a small pullback in the market last week. After the big run up we had expected such and there might more on the way. The market needs to put in a higher low and then resume its run and set new highs to turn the weekly trend positive. Earnings are bad but not as bad as analysts thought they would be. Estimates for Q2 are not falling as much as they normally do at this time of year, hopefully a positive sign. The economy really dragged in the first quarter but has avoided recession and economic growth around the world is slowly improving.

Watch our Market Outlook: https://www.youtube.com/watch?