BACK IN THE BLACK

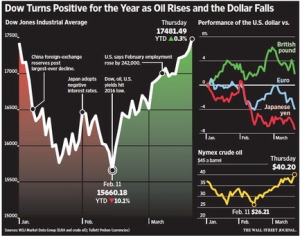

The market continued its remarkable comeback and put in gains for the 5th week in a row, and is now up for the year. The overall US stock market as measured by the VTI was up 1.38% (dividend adjusted), the SP500 as measured by the SPY was up 1.32% (dividend adjusted), international markets (x-US) as measured by the VXUS was up by 0.63% and the aggregate bond index as measured by the AGG was up by 0.69%.

The SPY is just under 2 standard deviations above its 50-day moving average, normally indicating an overbought condition. But this market has continued to rise over the last few weeks despite opportunities to turn south.

The market was helped by the Federal Reserve, which prior to Wednesday was still holding the line on four interest rate increases this year. But the Fed got in tune with the market projections, and said rates would rise at a more measured pace, probably two more times this year.

ECONOMIC REPORTS

Economic reports were for the most part positive this week. The New York Empire Manufacturing Report went into positive territory for the first time since July. The Philadelphia Fed Manufacturing Survey also showed positive numbers, the first time since August. Both imports and exports at the west coast ports of Los Angeles, Long Beach and Oakland showed increases. There was some negative data on a report measuring jobs openings. Numbers were revised down for December to 5,281,000 from 5,607,000. But the unemployment report continued to be low, coming in at 268,000 in initial claims. That is up slightly from last week but still a very good number. We have now been at less than 300k on the unemployment claims report for 54 weeks and that is the longest streak since 1973.

SUBPRIME AUTO LOANS

Problems are emerging with subprime auto loans. Delinquencies greater than 60-days on loans packaged into bonds over the last five years are now at the highest level in two decades, 5.16%. Moreover, the rate is of delinquency is higher on the new loans than the older loans, indicating that standards for loans have recently been made easier. Subprime auto loans have helped power the auto industry’s recent record sales, and any pullback in the availability of these loans would impact the auto manufacturers.

US DOLLAR

The Chinese currency, the yuan, had its biggest one-day advance against the dollar, rising 0.52%. Although analysts do not seem to believe the currency’s strength is a sustainable trend. As a side note, Trump and other candidates have been arguing that China is manipulating their currency lower, the exact opposite of what is really happening.

Other currencies have also been gaining against the dollar, the WSJ Dollar Index, which tracks the dollar against 16 currencies, hit its lowest level since June on Thursday (see the chart above). A lower or stable dollar should be a positive for earnings for the SP500, as it makes their products more competitive overseas. A rising dollar was one of the obstacles to rising earnings last year.

COMMODITIES

The 3.5 year decline in commodities might be coming to an end. The CRB Commodity Index is up 13% over the last 35 days. Commodities tend to run in trends that last a good length of time so if this is not a head fake we might be at the start of a bull run.

UNINTENDED CONSEQUENCES

Duke University’s Fuqua School of Business did a survey of CFOs to determine the impact of a rise in the minimum wage to $15. Such a dramatic rise would be negative on employment. 41% said they would lay off current workers and 66% said it would slow the pace of future hiring. 66% also said benefits would be cut and 49% said prices would have to be raised. The point is that such a huge increase over a short time period will impact the way business is done, probably speeding up the pace of automation and lowering employment.

THE RISE OF TRUMP

Speaking of unintended consequences, the rise of Trump and his style closely matches recent Latin American authoritarian figures like Hugo Chavez and Rafael Correa. In the leading Venezuelan daily, the “El Universal”, Roberto Giusti compared Chavez and Trump, “consummate showmen with a shrewd ability to manage emotions of a large audience and, using a mixture of half-truths, pin the blame for people’s ills on enemies, real or imagined.”

In Latin America, the populists blame big business and corrupt politicians for working with the United States. Trump has spun that strategy around and blames our problems on immigrants and the “very smart” Chinese and Mexicans that have outfoxed our “stupid” leaders. Bernie Sanders strategy is a softer version of Trump but puts the blame on big business and the rich. Neither candidate has realistic solutions.

Incredibly, in 1998, Chavez actually got the majority of the middle class vote. Look at Venezuela now. There barely is a middle class left and the country’s economic system has been destroyed.

SUMMARY

The market has come a long way in a short time. Economic news in the US continues to be on the favorable side, and the fear of a recession which really hammered the market earlier in the year has somewhat faded. The rising price of oil as helped that. At this point, the market is probably somewhat overbought. So some kind of pullback would not be unexpected.