Happy, or maybe, not so happy, anniversary. It was one year ago on May 21 that the SPY (ETF for the SP500) hit it’s high of $213.50. On Friday it closed at $205.49. That is a drop of 3.8%. Although adjusted for dividends, the drop is only 1.7%. So basically the market is in about in the same position as last year, with some pretty good volatility along the way to the down side.

The markets had lots of ups and downs this week but when it was all over equities did manage a gain of 0.45% on the VTI (overall US stock market) and 0.36% on the SPY. International stocks (VXUS) were up 0.59%.

On Monday the market shot higher by almost 1% on news of Warren Buffet’s Berkshire Hathaway’s $1b investment in Apple. But that gain didn’t hold as the market reversed direction and fell 0.9% on Tuesday on fears that interest rates will rise faster than expected this year. Wednesday was an up and down day and the market finished at its midpoint, roughly in line with the previous day. Thursday the market dropped below the support line of $203.90 but managed to rally and closed above that number. And on Friday the market advanced to finish with a modest gain for the week.

The US dollar also increased, up by 0.66%. The USD is now up 2.92% for the month

FED / INTEREST RATES

Higher CPI numbers (see below) as well as upbeat housing and industrial production reports got the market anticipating that an interest rate rise might happen sooner (June or July) rather than later. That was confirmed on Wednesday when the Fed released their minutes from the April meeting. Inside the minutes was this quote, “Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee’s 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June.”

We think that the key words in this quote are that “[if] labor market conditions continue to strengthen,” that is something that has not happened since the April meeting. Labor markets have been flat at best.

Despite that, recent comments by other Fed officials have emphasized that the market was out of line with the Fed’s desire to increase rates two times this year. Markets were anticipating maybe one cut late in the year. But now the markets are finally getting the message. In the last week, the chance of a June rate hike has increased from less than 10% to over 30% now.

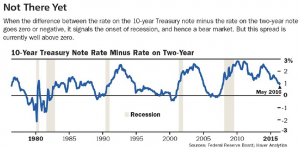

YIELD CURVE FLATTENING

There has been a lot of talk about the flattening of the yield curve and if that is telling us something about a possible recession down the road. The 2-year note has increased this month by 12 basis points while the 10-year is up by only 2 basis points, meaning the spread has fallen by 10 basis points to .96 as of Friday, down from 1.21 at the end of last year. The spread is now at its narrowest point since December of 2007. The 2-year has been rising due to the possible Fed increase and the higher CPI numbers (see below), while the 10-year is being held down by negative rates overseas.

As written about in this week’s Barron’s, the spread normally has to hit zero to indicate the onset of a recession.

APPLE

Warren Buffet’s Berkshire Hathaway announced on Monday that they had taken a $1b in stake in Apple. We wrote on April 29th that Apple shares looked cheap and it looks like at least one other person noticed! The shares jumped 3.7% on the news, or $18.4b in terms of market capitalization.

YUAN

After a frightening start to the year, the Chinese yuan picked up steam and rallied into late April. But since then, the yuan has been falling against the dollar to the tune of 0.6%. The People’s Bank of China’s (PBOC) mandate is to promote growth, often by pumping currency into the economy. That weakens the yuan. But if the currency weakens too much, Chinese business and citizens will look to get money out of the country and into safe-havens like the United States. That has been happening for a while now, but the recent yuan rally brought some relief. If the currency continues to fall that will accelerate the process. The PBOC might be forced to step into their falling reserves to defend the currency.

But there are other consequences to a lower yuan. The big market selloff at the beginning of the year was due in large part to slowing economic growth in China coupled with the weakening yuan. The selloff was a worldwide phenomenon. As the currency falls, Chinese exports should increase and imports decrease. That means lower growth across the globe. The fear of a domino effect that impacts economies worldwide might lead to another market sell off.

The number one goal of the Chinese government is social stability and that means a steady currency. We expected a gradual decline in the value on the yuan and we will have to be on watch to its future path.

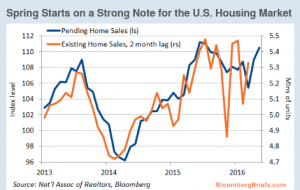

ECONOMY

Industrial production increased by 0.7% in April. That was the biggest rise since November of 2014. Factory output improved by 0.3%. Housing started rose by 6.6% in April and building permits were up by 3.6%. Sales of homes are on the rise.

The Empire Manufacturing report which measures manufacturing activity in the New York region declined. The index has been up the two months prior. The Philadelphia region also reported lower readings.

LEI/CEI

A good measure of an on-coming recession is the ratio of the Conference Board’s Leading Economic indicators to the Coincident Indicators. A series of new lows might indicate that a recession is on the way. But we have not seen that yet.

Bespoke Invest

PAYROLL

Initial unemployment claims came in at 278k. That is an improvement over last week’s 294k. The two prior payroll reports moved in the wrong direction so it was good that we got positive payroll numbers this week.

INFLATION

The consumer price index put in its biggest monthly increase since February of 2013, rising by a seasonally adjusted 0.4% in April. Gas prices contributed to the increase, up by 8.1%. The increase, excluding food and energy, was up by 0.2%. Core prices were up 2.1% year over year.

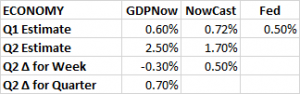

GDP ESTIMATES

The Atlanta Fed’s GDPNow forecast for Q2 declined slightly from 2.8% to 2.5%. The drop was a result of (1) a lower forecast for real residential investment growth, (2) a drop in the forecast for real consumer spending growth and (2) a decline in inventory investment. However, the NY Fed number increase from 1.20% to 1.70%. If we split the difference we have a 2.1% estimate for Q2 growth.

SUMMARY

The markets have begun pricing in the possibility of an interest rate increase in June or July. That, coupled with higher inflation data, has pushed up short-term interest rates while longer-term rates have been stable, resulting in a flatter yield-curve. The Chinese yuan is declining again. Economic numbers were mixed and payroll numbers improved but overall Q2 growth is on path to be higher than Q1.