Week Ending 5/6/2016

The market was down slightly for the week, the overall US market as measured by the VTI fell 0.50%, international markets as measured by the VXUS were down 2.38% and the aggregate bond index as measured by the AGG rose 0.26%. The US dollar also rallied by 1.29% and crude oil fell by 2.74%.

The market has now fallen two weeks in a row but the move has been small. The SP500 (SPY) is only off 2.1% from its recent high of 210.10 on April 20th. On Friday, the market opened almost at the low of the day, pushed against a resistance line (see the yellow line below) and bounced right off it and finished pennies off its high from the day. So even in the face of falling prices over the last couple of week, the equity market has shown pretty good strength.

REITs had a big week. The VNQ rallied 4.6% and broke out to a new high. In the face of a slow growth economy, low interest rates, and stable to increase real estate values, higher yielding REITs have become more attractive.

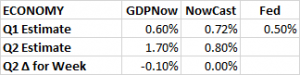

GDP Q2

Q2 GDP estimates remain in line with last week, GDPNow (Atlanta Fed) drop by 10 basis points. to 1.70%. The NowCast (NYFed) remained at 0.80%.

MANUFACTURING

The Institute for Supply Management’s (ISM) Index for manufacturing fell to 50.8 from 51.5 in April, but remained about the breakeven level of 50 indicating expansion for the second straight month. It was a disappointing number but at least it was still positive. The export index, helped by a lower dollar, rose to its highest level since November of 2014.

Global PMI fell to 50.1 from 50.5. This is just 0.1 point above the 39-month low from February of this year. Employment fell for the third month in a row. Inventories did decline at the fast pace since July of 2013. That means if sales picks up, it would translate into new manufacturing, as opposed to working down existing inventory.

Japan fell to 48.2, probably impacted by the higher yen. The UK PMI dropped to 49.2, dropping into contraction territory for the first time in three years. Uncertainty from the Brexit vote gets the blame there. China fell to 49.4, but that is still up from the September low. Brazil was a disaster, coming in at 42.6. The Eurozone did increase by 0.1 to 51.7. Other positive countries were Australia, Mexico, Vietnam and emerging Europe.

Overall, 60% of individual countries are still in expansion territory, that is down from 69% last month. The global economy appears to be just keeping its head barely above water and we are still on a global recession watch.

SERVICES / COMPOSITE

The numbers were better on the services side. The ISM Non-Manufacturing Index rose to 55.7, up from 54.5. That is the highest level this year. So while manufacturing was a disappointment, the service number was better than expected.

Combined, the ISM Composite Index rose to 55.1. That also is the highest reading of the year.

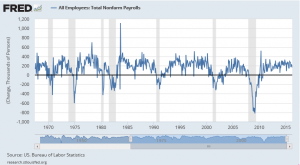

EMPLOYMENT NUMBERS

Employment statistics have been the linchpin of the US economy in recent months. But this week the numbers were not as strong as we have become accustomed to. Jobless claims came in at 274k, which was the highest reading in five weeks. Relatively speaking 274k is a very good number, just not as good as the very low numbers we have been seeing. The unemployment rate remains at 5%. Only 160k new jobs were created. That number was a disappointment and lower than the 200k consensus. It is going to be hard for the economy to keep creating 200k+ jobs per month in a slow growth economy.

In our quarterly webinar we cited 5 factors that often are leading indicators for a recession, two of them are rising jobless claims and declining employment. While rising claims were up and the change in newly created jobs was down, these two numbers are are not yet indicative of a trend.

The weaker than expected employment numbers likely diminished the chances of a June rate increase by the Fed.