HIGHLIGHTS

- US equities up by 1.29%, fourth straight week of gains.

- The market is closing in on the all-time record without a 5% correction.

- The US and the global economy is strong.

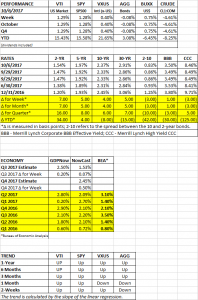

PERFORMANCE

US equities advanced for the fourth week in a row, up 1.29% and continued their recent outperformance over international equities, which advanced by 0.40% for the week. Bonds fell slightly, down 0.08%, as interest rates were up about 5% across the curve.

The general consensus over the last few weeks has shifted. In August, the mood was that we would have some kind of pullback, but now, the “experts” seem to think it is smooth sailing ahead, at least for the near-term. That in itself may be some kind of warning.

This Monday will mark 333 business days without a 5% pullback. The last time that happened was the period beginning on November 23, 1994. Assuming nothing crazy happens on Monday or Tuesday, this will be the longest such period ever.

ECONOMY

The Global Purchasing Managers Index (PMI) came in a 53.2 in September, its highest level since May of 2011, indicating continued worldwide growth. The international economy is now back to pre-crisis growth levels. Almost every country is now in growth mode. Developed markets showed a slight edge over emerging markets, and Europe was the strongest region.

Here in the United States, the Institute for Supply Management’s (ISM) September Manufacturing Report came in at a very strong 60.8. That is up from 58.8 in August and it is the highest reading since May of 2004. It was the 13th consecutive month of growth in manufacturing.

Initial claims for unemployment fell by 12,000 to 260,000. Claims are still being negatively impacted by the hurricanes but are at levels that are considered historically low indicating a continued tight job market.

The Atlanta Fed’s GDPNow shows Q3 growth at 2.50% and the NY Fed’s Nowcast has growth at 1.53%. The Nowcast, which also is currently forecasting Q4, has growth improving to 2.45%.

SCOREBOARD