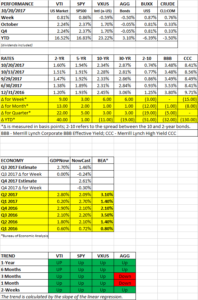

PERFORMANCE

The endless rally continued amidst a sea of calm, as US equities increased by 0.81%. It has now been 350 days since the last pullback of only 3%, the second longest streak on record.

The slowly climbing market represents a stark contrast to 30-years ago this past week when the 1987 market crashed. Fuel for the rally continues to be solid financial reports. So far, 70% of the companies that have reported earnings have topped estimates, and 72% have beaten on the top-line. The market was also helped when Senate Republicans agreed on a budget that would allow tax cuts to pass with a majority of the votes, rather than 60.

International equities fell by 0.59%. Bonds dropped by 0.50% as interest rates increased. The spread between the 10 and 2-year narrowed by 3 basis points. The dollar was up 0.87% and crude rallied by 0.76%.

QUARTERLY WEBINAR

Our quarterly Review/Outlook Webinar was done on Saturday. You can find it at this link: https://www.youtube.com/watch?v=2d-pQLkfDVI.

EXPLODING US DEBT

Amidst all the talk about the tax cut plan, the resulting increase in the Federal deficit is for the most part being ignored. Proponents of the tax cut argue that increased growth will pay for the resulting deficits, but most economists do not buy that to the extent necessary to cover the lost revenue.

In this week’s Barron’s, Gene Epstein writes about the mushrooming debt and how it might lead to exploding inflation. In his 2007 memoir, Alan Greenspan predicts inflation will jump much higher around 2030, to around 4.5% or higher.

Greenspan’s predictions are in sync with the non-partisan Congressional Budget Office, that debt will soar due to exploding eldercare entitlements. In the face of out of control debt, the pressure would be immense for the Fed to print money and buy a portion of the federal debt. That would be liking pouring gasoline on a fire, causing inflation to burst higher.

When the Fed went to the printing presses over the last decade, inflation didn’t pop. But 2030 is likely to be a different era than what we just went through. The last few decades have been helped by the disinflationary impact of cheap labor around the world. But that will be played out by 2030. Plus, the amount of money needed to print will be far greater than what we just went through with no end in sight.

Higher inflation will depress the dollar, which will result in a sell-off of US bonds by foreigners, compounding all of the above problems.

All the more reason to seriously consider how the proposed tax cuts will impact the national debt long-term. What we really need is tax reform to promote an efficient economy, not pure tax cuts.

ECONOMY

Jobless claims hit a record low of 222,000. The job market continues to be the bright spot in this economic expansion.

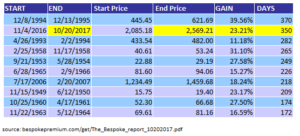

SCOREBOARD