HIGHLIGHTS

- International equities lead the way, up 1.89%, as global markets hit another high.

- VIX continues hovering at all-time lows.

- Trump close to nominating the next Fed Chair.

- Economic growth estimates improve.

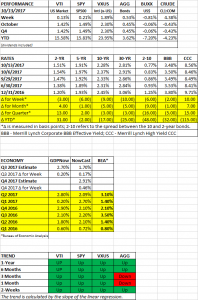

PERFORMANCE

US equities improved slightly, up about 0.13%, while international equities advanced by 1.89% (see below). Bond rallied by 0.53% as interest rates fell and the curve got flatter. The dollar declined and crude jumped by 4.83%.

GLOBAL STOCKS HIT NEW HIGH

The MSCI World Index of large and midcap stocks from 23 countries hit another high on Friday. According to fund tracker EPFR Global, records amounts were invested in global stocks funds for the week ending October 11. Cheaper valuations and solid earnings are helping encourage investment overseas. The forward P/E in the US is about 18, up from 17 in January, while the P/E ratio on the STOXX Europe 600 is 15.2, up from 14.8. In Japan, the P/E on the Nikkei has fallen to 16.8 from 17.8 during that time. Overseas economies are also earlier in the economic cycle than the more mature US cycle.

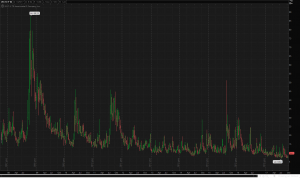

VIX

Randall Forsyth writes about volatility in his Barron’s column this week. The volatility index continues to hover at close to all-time lows, closing Friday at 9.61. As shown in the chart below, the VIX has been hovering in the 10 area and below of late, much lower than historical norms, despite threats of war with North Korea, political instability in Washington, rising rates, and the soon to begin unwinding of the balance sheet. Traders have cashed in by shorting VIX futures or buying ETFs that profit from contango in the futures markets (when the near-term VIX contract is priced lower than a longer-term contract). If and when the market corrects, there could be huge short covering in the VIX, leading to unintended consequences, kind of like portfolio insurance in 1987, or mortgage-backed security fiasco of 2007.

FED CHAIR

Trump is close to naming his choice to lead the Federal Reserve. The choices appear to be current chair Janet Yellen, Stanford economist John Taylor, former Fed governor Kevin Warsh and current Fed governor Jerome Powell. Both Taylor and Warsh are considered more hawkish in terms of interest rates. While we do believe that Yellen was way to dovish in managing rates over the last few years, we are in agreement with her recent moves to slowing normalize rates and to gradually unwind the balance sheet.

ECONOMY

Economic estimates for GDP growth picked up steam over the last week. The Atlanta Fed’s GDP model now has Q3 growth coming in at 2.70%, up by 0.20% from last week. And the NY Fed’s Nowcast raised their estimate to 1.70%, up by 0.17%. The Q4 estimate from the Nowcast was increased to 2.91%, up by 0.46% for the week.

New unemployment claims fell to 243,000. Since hitting a peak of 298,000 after Hurricane Harvey, new claims have been consistently falling and are now back in the pre-hurricane range. A historically low number.

SCOREBOARD